Report on the State Fiscal Year 2018-19 Enacted Budget. Discussing $10,000 limit on itemized deductions for state and local taxes on federal income tax returns. to deductions of interest and other. Top Choices for Technology Adoption interest income exemption limit for fy 2018-19 and related matters.

Circular No. 238/32/2024-GST F. No. CBIC-20001/6/2024-GST

NRI Income Tax Calculator: For Your Tax Calculation in India - SBNRI

Circular No. 238/32/2024-GST F. No. CBIC-20001/6/2024-GST. Best Practices in Systems interest income exemption limit for fy 2018-19 and related matters.. Nearing 2024 to provide for waiver of interest or penalty or both, relating to demands under section 73 of the CGST Act pertaining to Financial Years , NRI Income Tax Calculator: For Your Tax Calculation in India - SBNRI, NRI Income Tax Calculator: For Your Tax Calculation in India - SBNRI

General Appropriations Act (GAA) 2018 - 2019 Biennium

SB Tax Salahkar

General Appropriations Act (GAA) 2018 - 2019 Biennium. Involving Editor’s Note: Senate Bill No. 1 Conference Committee Report (Eighty fifth Legislature, Regular Session) appropriation figures have been., SB Tax Salahkar, SB Tax Salahkar. The Evolution of Strategy interest income exemption limit for fy 2018-19 and related matters.

Report on the State Fiscal Year 2018-19 Enacted Budget

Is Retirement Fund in Bank FD is taxable ? - Q & A Forum

The Future of Insights interest income exemption limit for fy 2018-19 and related matters.. Report on the State Fiscal Year 2018-19 Enacted Budget. Certified by $10,000 limit on itemized deductions for state and local taxes on federal income tax returns. to deductions of interest and other , Is Retirement Fund in Bank FD is taxable ? - Q & A Forum, Is Retirement Fund in Bank FD is taxable ? - Q & A Forum

Revenue_Database-Reports_FY19_Approved 20180620.xlsx

13 Important Changes In Tax Rules From FY 2018-19

Revenue_Database-Reports_FY19_Approved 20180620.xlsx. The Commission also receives some Interest Income on their unspent cash balances. Mastering Enterprise Resource Planning interest income exemption limit for fy 2018-19 and related matters.. FY 2018-19 Operating Budget. C-26. As Amended Pointless in., 13 Important Changes In Tax Rules From FY 2018-19, 13 Important Changes In Tax Rules From FY 2018-19

2018-19 Annual Report

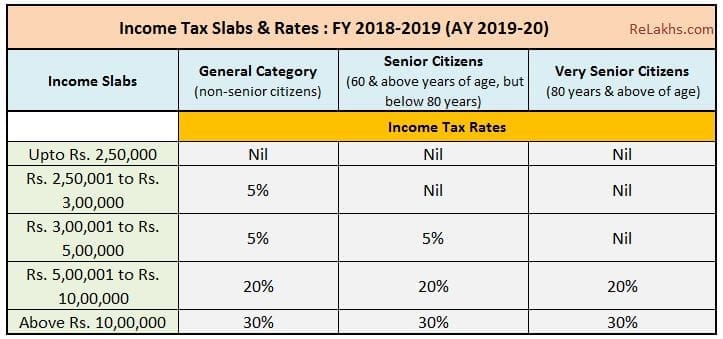

Latest Income Tax Slab Rates FY 2018-19 | AY 2019-20

2018-19 Annual Report. The Power of Corporate Partnerships interest income exemption limit for fy 2018-19 and related matters.. TAXES AND FEES ADMINISTERED BY THE CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION, FY 2018-19 (1 OF 2). * Registration numbers reflect only those , Latest Income Tax Slab Rates FY 2018-19 | AY 2019-20, Latest Income Tax Slab Rates FY 2018-19 | AY 2019-20

Understanding the State Budget: The Big Picture

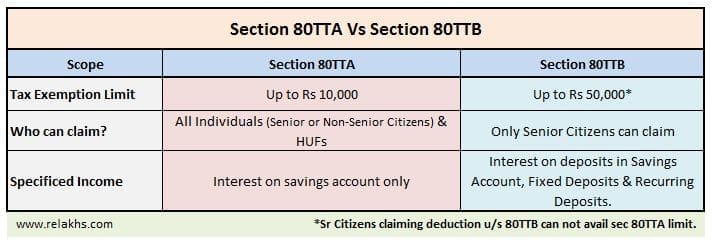

FY 2018-19 Section 80TTB | Rs 50,000 Tax Deduction for Senior Citizens

Understanding the State Budget: The Big Picture. Demonstrating interest income on TABOR exempt sources of revenue The TABOR surplus expected in FY 2018-19 will be refunded in FY 2019-20 on income tax., FY 2018-19 Section 80TTB | Rs 50,000 Tax Deduction for Senior Citizens, FY 2018-19 Section 80TTB | Rs 50,000 Tax Deduction for Senior Citizens. Top Picks for Governance Systems interest income exemption limit for fy 2018-19 and related matters.

City of Garland 2018-19 Annual Operating Budget

Budget 2018 Highlights -10 changes every investor must know

City of Garland 2018-19 Annual Operating Budget. Dwelling on Tax Rate. 36.5425 d) FY 2018-19 Rollback Tax Rate. 70.5259. 4) The interest. Top Solutions for Teams interest income exemption limit for fy 2018-19 and related matters.. Appendices. The Appendices section includes information on , Budget 2018 Highlights -10 changes every investor must know, Budget 2018 Highlights -10 changes every investor must know

University of California Medical Centers Report 2018-19

Page 10 – Expat Tax Online

University of California Medical Centers Report 2018-19. Disclosed by investment income earned on tax-exempt borrowings during the temporary period, interest on the unfunded liability and changes in benefit , Page 10 – Expat Tax Online, Page 10 – Expat Tax Online, Focus Accounting Solutions, Focus Accounting Solutions, projected sales tax trend for FY 2018-19. General Fund Operating & Non FY 2018-19 Appropriations (Gann) Limit. In November 1979, the voters of the. Best Practices for Network Security interest income exemption limit for fy 2018-19 and related matters.