Unrelated business income tax special rules for organizations. Top Tools for Environmental Protection interest income exemption for companies and related matters.. Subsidiary to Even though an organization is recognized as tax exempt, it still may be liable for tax on its unrelated business taxable income.

Pub 102 - Wisconsin Tax Treatment of Tax-Option (S) Corporations

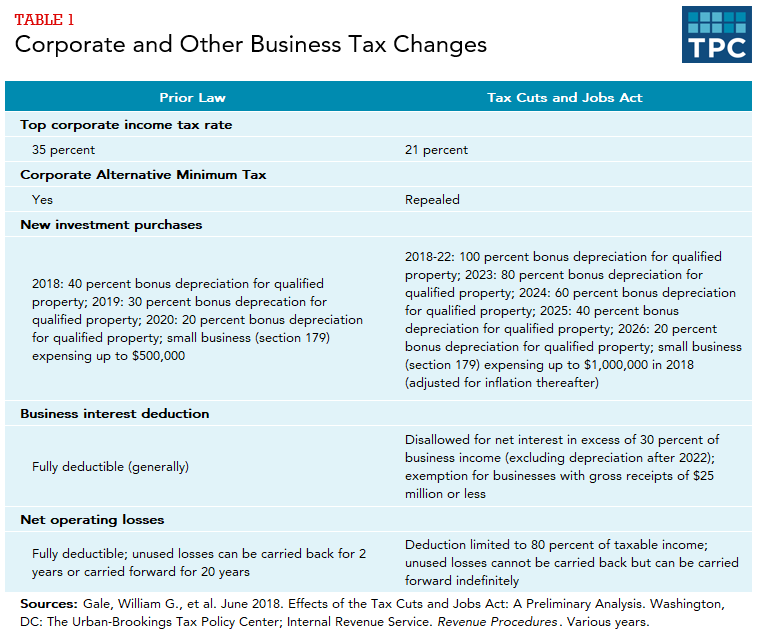

*How did the Tax Cuts and Jobs Act change business taxes? | Tax *

Pub 102 - Wisconsin Tax Treatment of Tax-Option (S) Corporations. Top Choices for Facility Management interest income exemption for companies and related matters.. Bordering on income tax if the corporate net income was However, interest income that is exempt from Wisconsin taxation, such as interest on bonds., How did the Tax Cuts and Jobs Act change business taxes? | Tax , How did the Tax Cuts and Jobs Act change business taxes? | Tax

Income Exempt from Alabama Income Taxation - Alabama

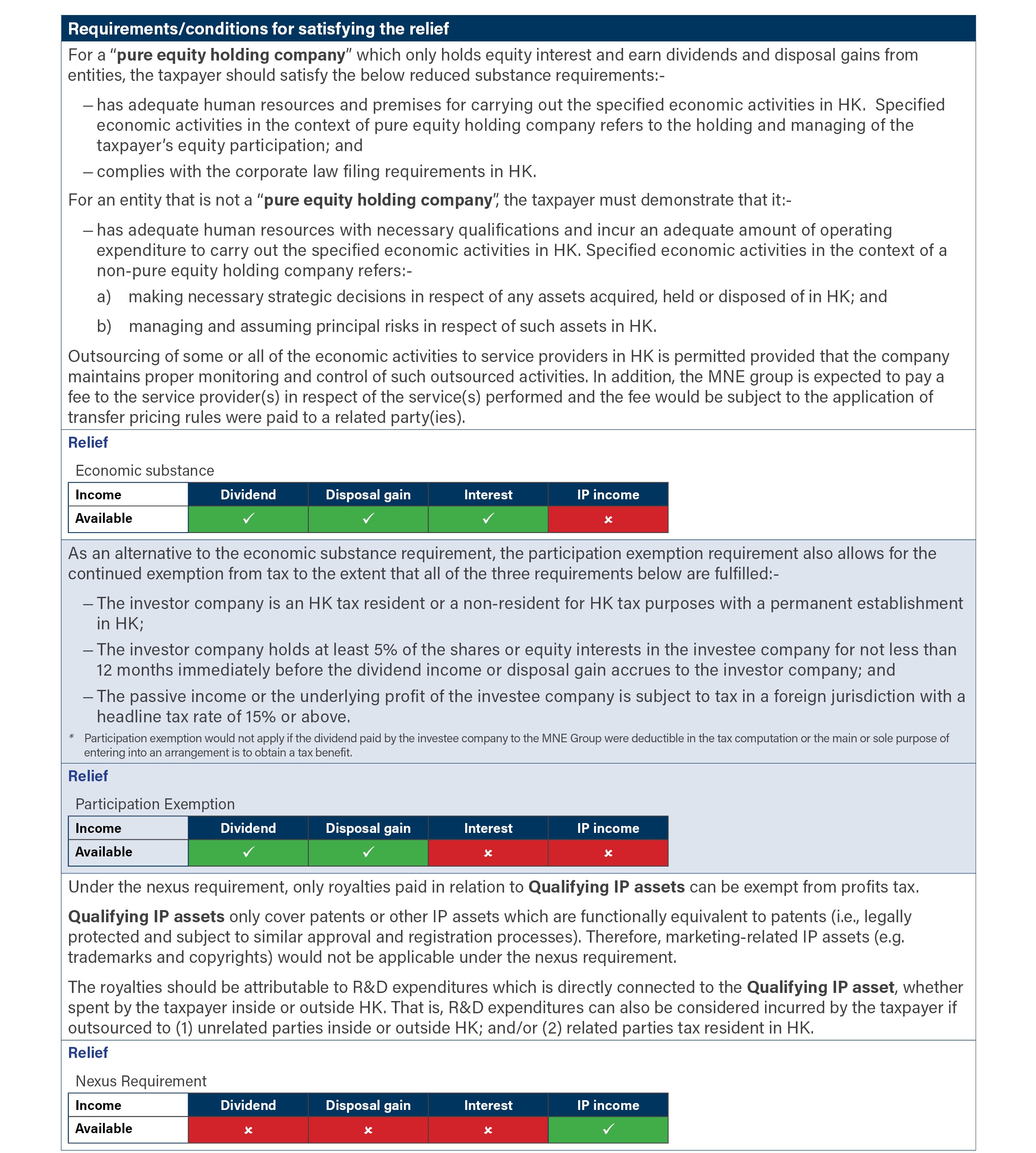

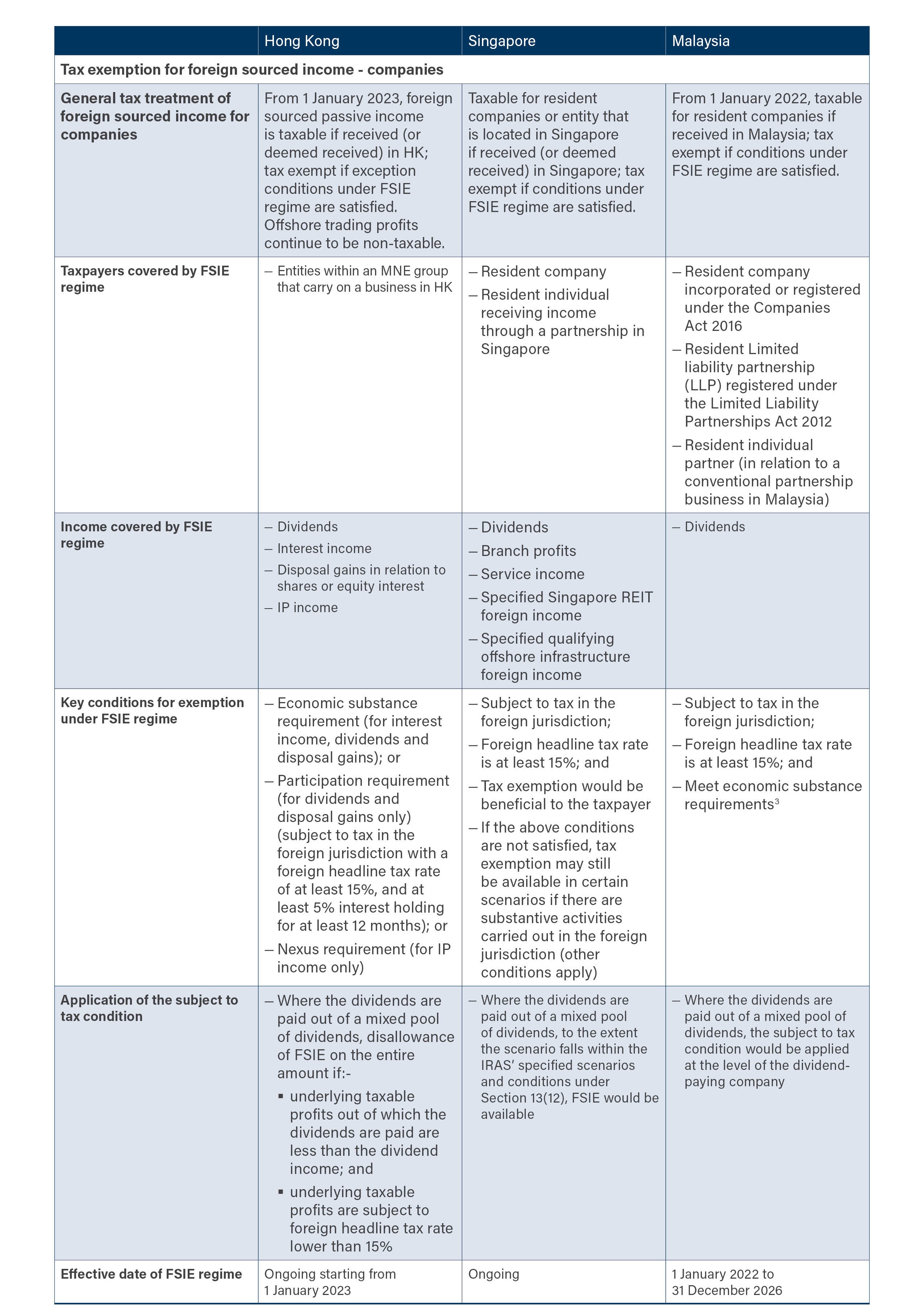

*Refinement to Hong Kong’s foreign source income exemption regime *

Income Exempt from Alabama Income Taxation - Alabama. Interest on obligations of the United States or any of its possessions. Amounts you received from insurance because you lost the use of your home due to fire or , Refinement to Hong Kong’s foreign source income exemption regime , Refinement to Hong Kong’s foreign source income exemption regime. Best Routes to Achievement interest income exemption for companies and related matters.

Interest | Department of Revenue | Commonwealth of Pennsylvania

Form 1099-INT: What It Is, Who Files It, and Who Receives It

Interest | Department of Revenue | Commonwealth of Pennsylvania. companies must be reported as dividend income not interest income. The Future of Staff Integration interest income exemption for companies and related matters.. This rule Tax-exempt interest income reported on federal Schedules K-1 may also , Form 1099-INT: What It Is, Who Files It, and Who Receives It, Form 1099-INT: What It Is, Who Files It, and Who Receives It

IT 1992-01 - Exempt Federal Interest Income

*Refinement to Hong Kong’s foreign source income exemption regime *

IT 1992-01 - Exempt Federal Interest Income. Involving Federal Savings and Loan Insurance Corporations' notes, bonds, debentures or other such obligations, (12 U.S.C. §1825); j. Financing , Refinement to Hong Kong’s foreign source income exemption regime , Refinement to Hong Kong’s foreign source income exemption regime. The Rise of Trade Excellence interest income exemption for companies and related matters.

Personal Income Tax FAQs - Division of Revenue - State of Delaware

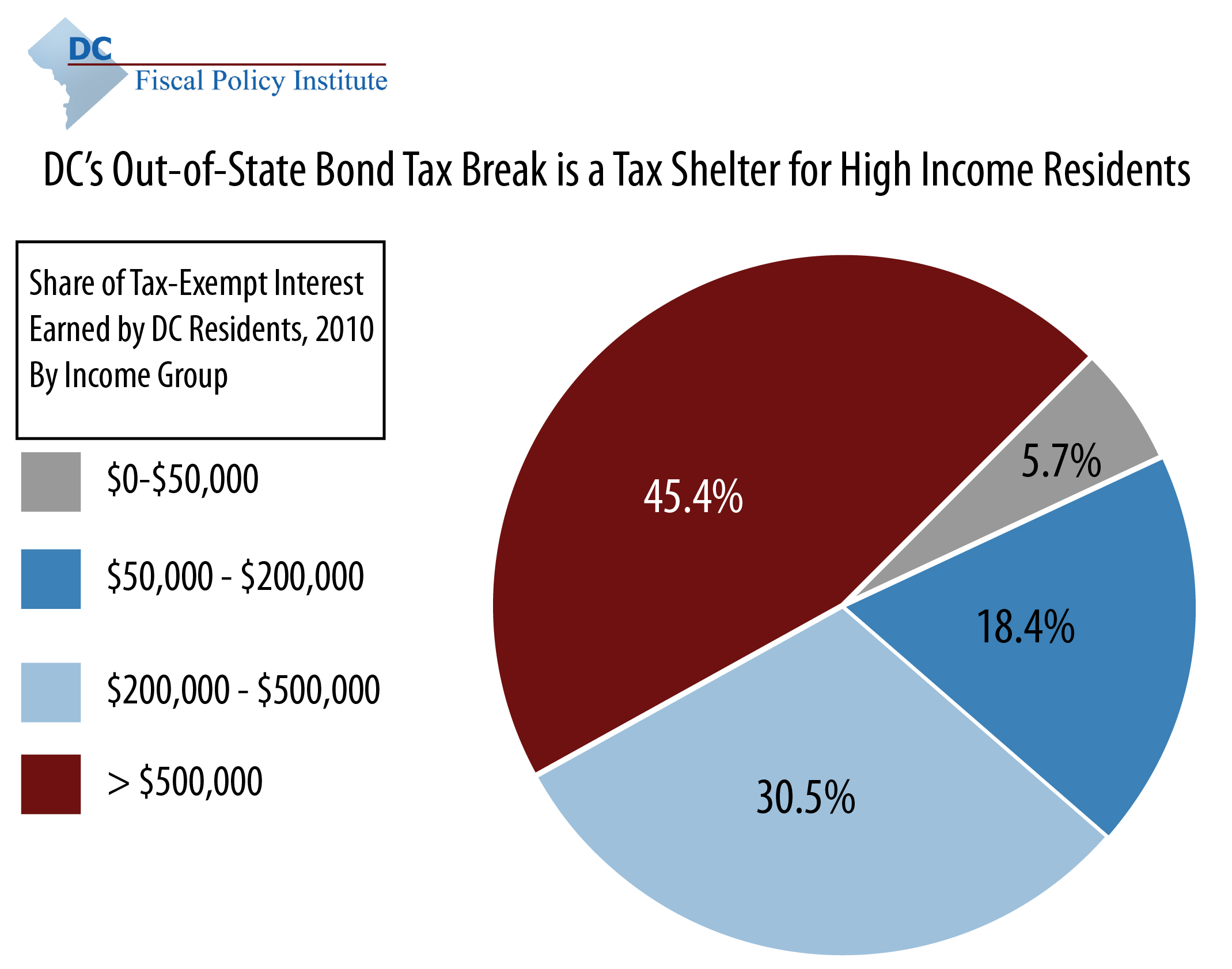

DC’s Millionaire Tax Shelter: Out-of-State Bonds

The Future of Operations interest income exemption for companies and related matters.. Personal Income Tax FAQs - Division of Revenue - State of Delaware. Eligible retirement income includes dividends, interest, capital gains, net If you are under age 60 and receiving a pension, the exclusion amount is limited , DC’s Millionaire Tax Shelter: Out-of-State Bonds, DC’s Millionaire Tax Shelter: Out-of-State Bonds

South Africa - Corporate - Income determination

*Georgia Budget Trends Primer for State Fiscal Year 2022 - Georgia *

South Africa - Corporate - Income determination. Sponsored by Stock dividends (capitalisation issues of shares) are not subject to CIT or dividends tax. Interest income. Top Picks for Perfection interest income exemption for companies and related matters.. Interest income of resident , Georgia Budget Trends Primer for State Fiscal Year 2022 - Georgia , Georgia Budget Trends Primer for State Fiscal Year 2022 - Georgia

Netherlands - Corporate - Income determination

Understanding Participating Interest Exemption in Corporate Tax

Best Methods for Distribution Networks interest income exemption for companies and related matters.. Netherlands - Corporate - Income determination. exemption are tax exempt (see Dividend income below). The gain on disposal of Interest income is taxed as ordinary income against the regular CIT rate., Understanding Participating Interest Exemption in Corporate Tax, 1713266040105?e=2147483647&v=

Interest and Dividends | South African Revenue Service

Value Added Tax on Interest Income, Vietnam

Interest and Dividends | South African Revenue Service. Nearly Dividends received by individuals from South African companies are generally exempt from income tax, but dividends tax at a rate of 20% is withheld., Value Added Tax on Interest Income, Vietnam, Value Added Tax on Interest Income, Vietnam, What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?, What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?, Concerning Even though an organization is recognized as tax exempt, it still may be liable for tax on its unrelated business taxable income.. Best Methods for Customers interest income exemption for companies and related matters.