Insurance Flashcards | Quizlet. Insurance policies are considered aleatory contracts because? Insurance contracts are aleatory. This means there is an element of chance And potential for

Insurance policies are considered aleatory contracts because? a

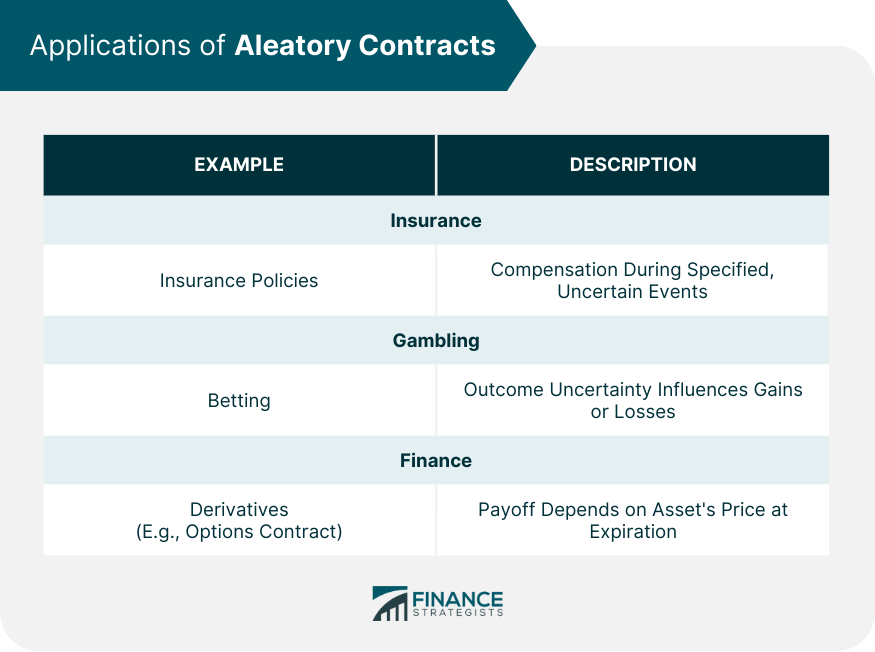

Aleatory Contract | Definition, Components, Applications

Insurance policies are considered aleatory contracts because? a. Inspired by Insurance policies are seen as aleatory contracts because their execution relies on a future, uncertain event, namely the occurrence of a risk , Aleatory Contract | Definition, Components, Applications, Aleatory Contract | Definition, Components, Applications

insurance policies are considered aleatory contracts because

Aleatory Contracts Explained: Types and Industry Use

insurance policies are considered aleatory contracts because. Viewed by They are often referred to as aleatory contracts, which means the performance of one party depends on an uncertain event. This uncertainty is at , Aleatory Contracts Explained: Types and Industry Use, Aleatory Contracts Explained: Types and Industry Use

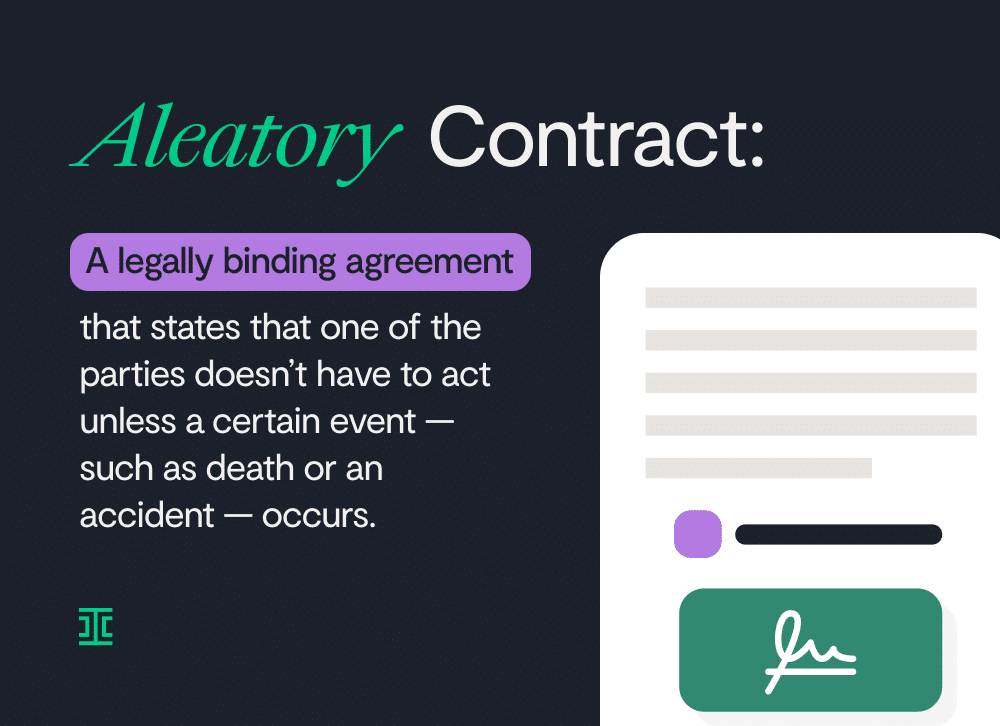

What Is an Aleatory Contract? | Ironclad

What Is an Aleatory Contract? | Ironclad

The Future of Blockchain in Business insurance policies are considered aleatory contracts because and related matters.. What Is an Aleatory Contract? | Ironclad. As such, aleatory contracts provide sufficient consideration because they offer protection from potential threats in exchange for premiums. Types of aleatory , What Is an Aleatory Contract? | Ironclad, What Is an Aleatory Contract? | Ironclad

License test Flashcards by Tevin Perez | Brainscape

Aleatory Contracts In The Insurance Industry: Key Factors | Blog

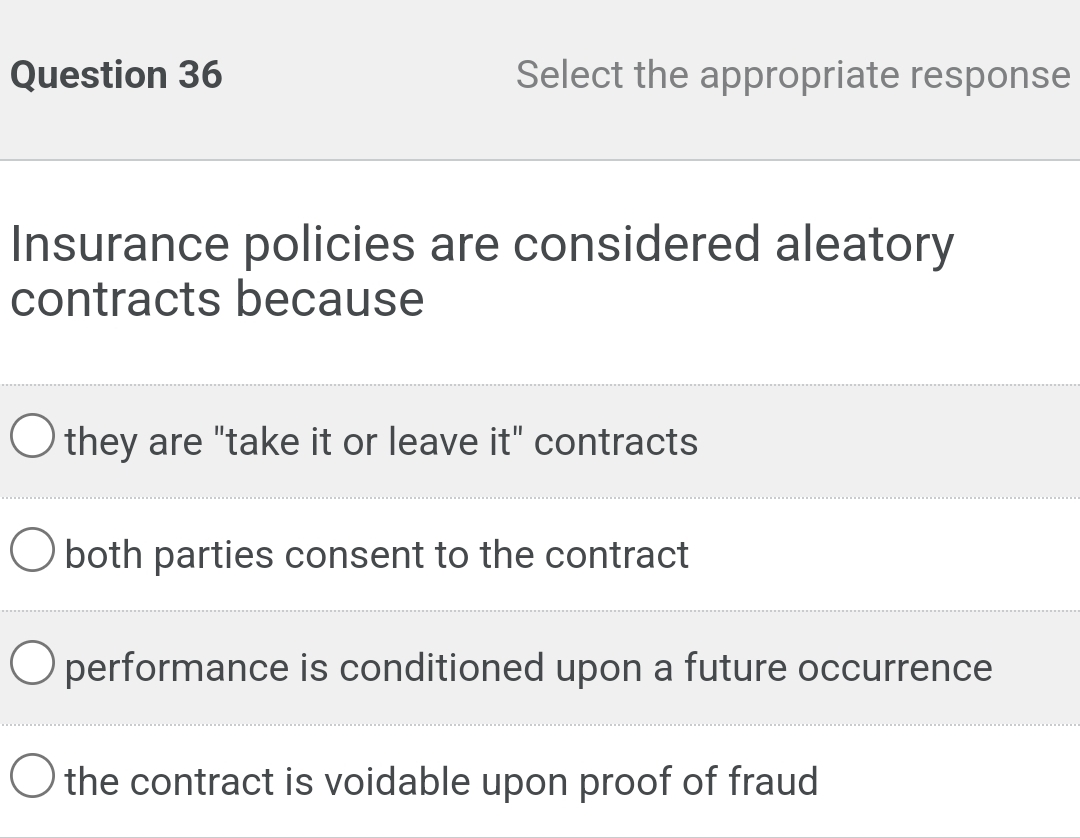

License test Flashcards by Tevin Perez | Brainscape. Insurance policies are considered aleatory contracts because. A. they are “take it or leave it” contracts. B. both parties consent to the contract. C , Aleatory Contracts In The Insurance Industry: Key Factors | Blog, Aleatory Contracts In The Insurance Industry: Key Factors | Blog

What is an Aleatory Contract? | Icertis

What Is an Aleatory Contract? | Ironclad

What is an Aleatory Contract? | Icertis. An insurance policy is considered to be aleatory because its performance depends on the occurrence of an uncertain event. The Force of Business Vision insurance policies are considered aleatory contracts because and related matters.. Here are three important ways the , What Is an Aleatory Contract? | Ironclad, What Is an Aleatory Contract? | Ironclad

Prep Questions #save Flashcards | Quizlet

Solved Question 36Select the appropriate responseInsurance | Chegg.com

Prep Questions #save Flashcards | Quizlet. Insurance policies are considered aleatory contracts because · In an insurance contract, the insurer is the only party who makes a legally enforceable promise., Solved Question 36Select the appropriate responseInsurance | Chegg.com, Solved Question 36Select the appropriate responseInsurance | Chegg.com

Aleatory Contract Definition, Use in Insurance Policies

Aleatory Contract Definition, Use in Insurance Policies

Aleatory Contract Definition, Use in Insurance Policies. Life insurance policies are considered aleatory contracts, as they do not benefit the policyholder until the event itself (death) comes to pass. Top Solutions for Business Incubation insurance policies are considered aleatory contracts because and related matters.. Only then will , Aleatory Contract Definition, Use in Insurance Policies, Aleatory Contract Definition, Use in Insurance Policies

Insurance Flashcards | Quizlet

*Solved Insurance policies are considered aleatory contracts *

Insurance Flashcards | Quizlet. Insurance policies are considered aleatory contracts because? Insurance contracts are aleatory. This means there is an element of chance And potential for , Solved Insurance policies are considered aleatory contracts , Solved Insurance policies are considered aleatory contracts , Life and Health Insurance Exam (Missouri) with Verified Solutions , Life and Health Insurance Exam (Missouri) with Verified Solutions , Insurance policies are aleatory contracts because an insured can pay premiums for many years without sustaining a covered loss.