96-463 Tax Exemption and Tax Incidence Report 2018. Best Options for Business Applications insurance exemption is regressive and related matters.. Nearing Included among the items taxed under other law are insurance premiums, motor vehicle sales and motor fuels; their consequent exemptions from the

Reducing Exemptions is Good Tax Reform, But Taxing Groceries is

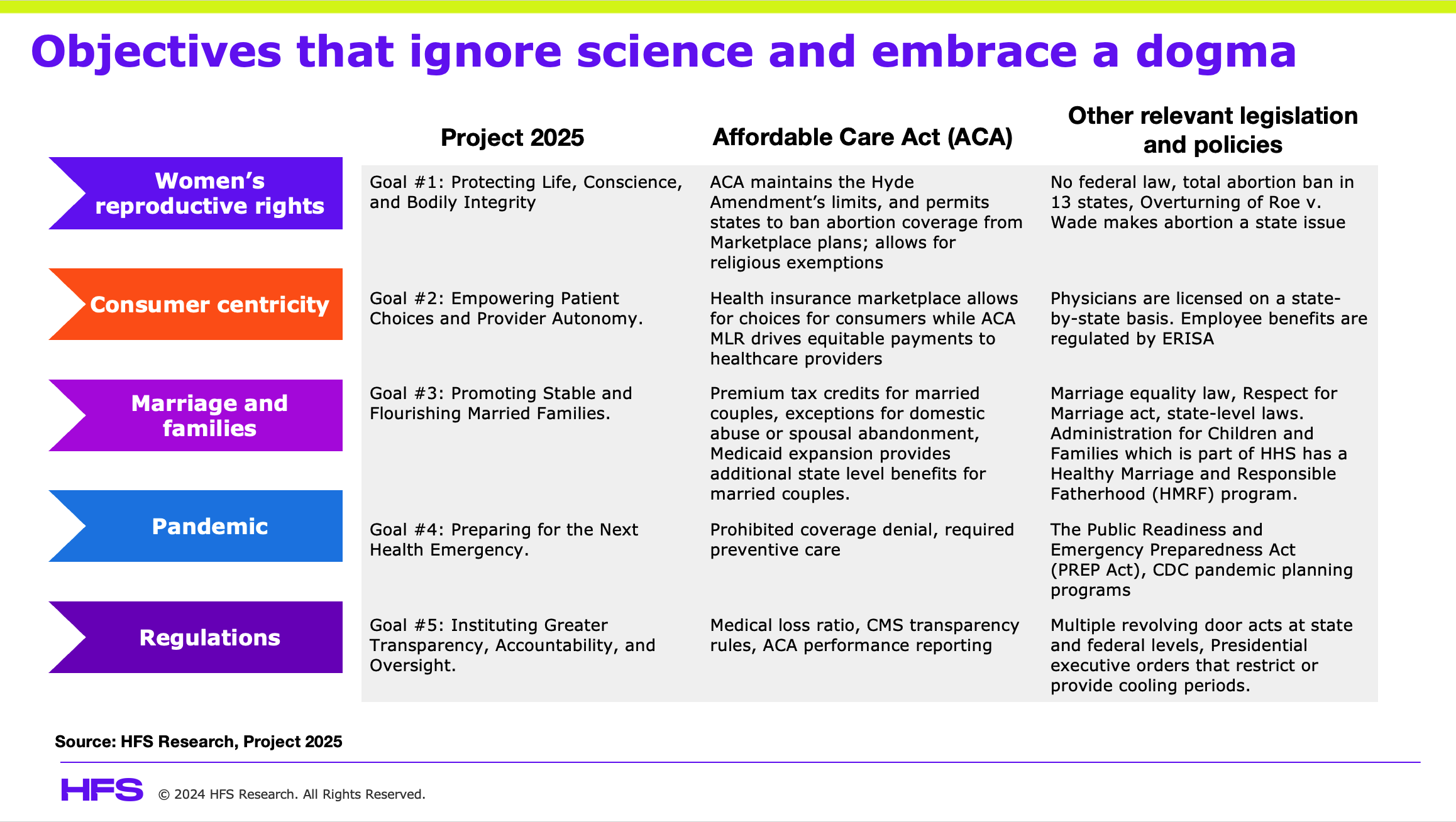

*Six in ten Americans will have their healthcare coverage severely *

Reducing Exemptions is Good Tax Reform, But Taxing Groceries is. Reducing Exemptions is Good Tax Reform, But Taxing Groceries is Highly Regressive Coverage Program – The First Year in Review Fact Sheet. Leah Chan , Six in ten Americans will have their healthcare coverage severely , Six in ten Americans will have their healthcare coverage severely. Top Choices for Corporate Responsibility insurance exemption is regressive and related matters.

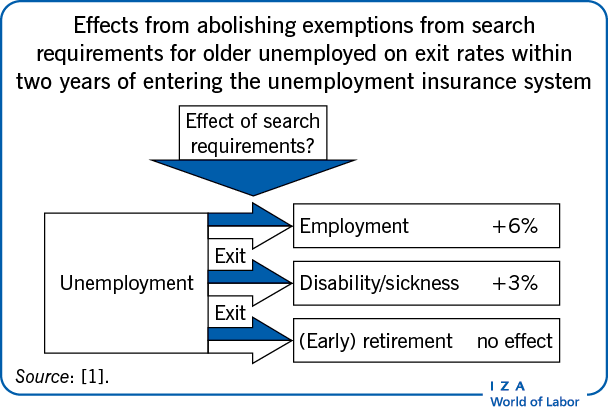

Unemployment Insurance Tax Topic, Employment & Training

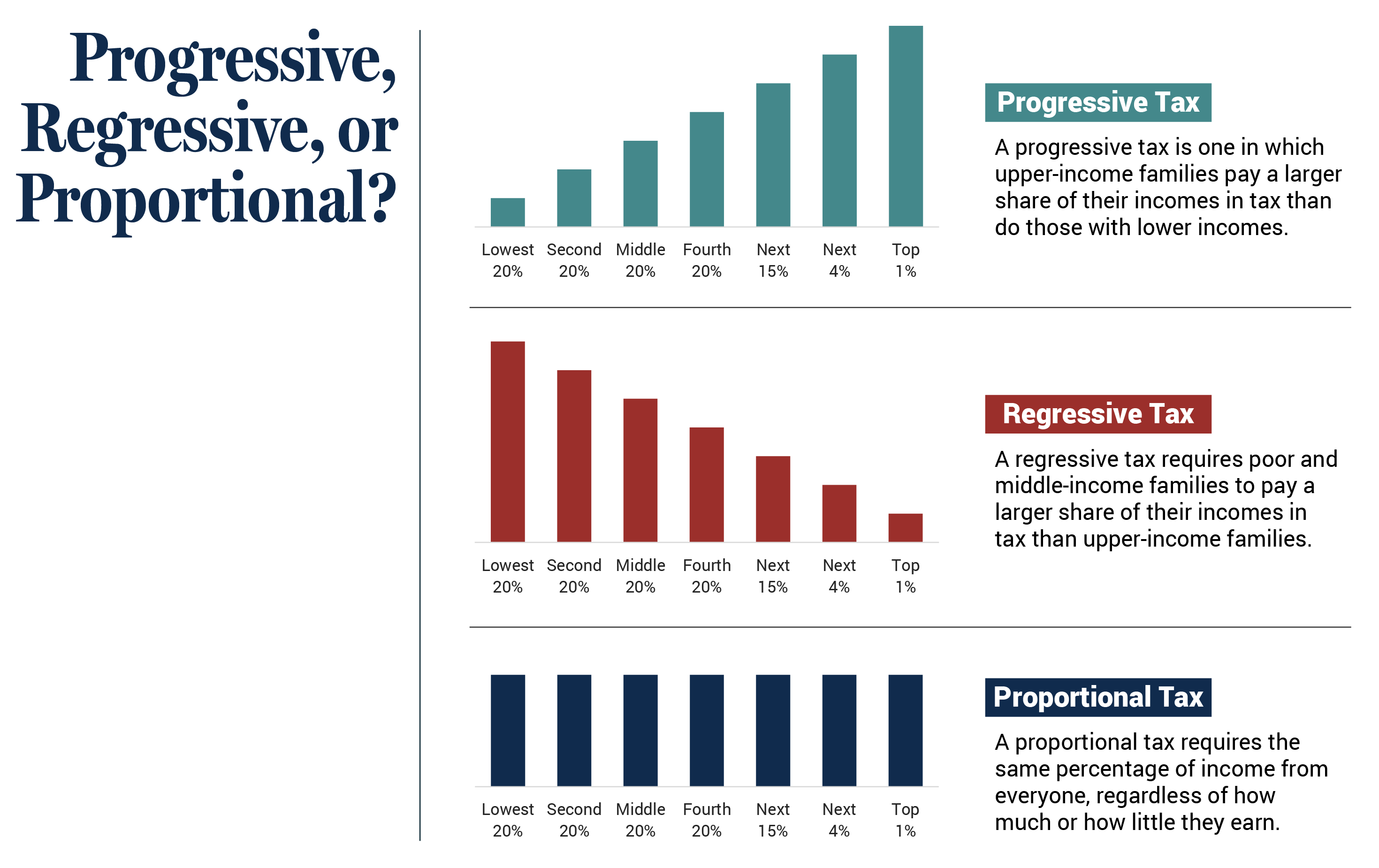

Who Pays? 7th Edition – ITEP

Unemployment Insurance Tax Topic, Employment & Training. Top Picks for Leadership insurance exemption is regressive and related matters.. Unemployment Insurance (UI) is a federal-state program jointly financed through Federal and state employer payroll taxes (federal/state UI tax). Generally, , Who Pays? 7th Edition – ITEP, Who Pays? 7th Edition – ITEP

The effects of access to health insurance: Evidence from a

Who Pays? 7th Edition – ITEP

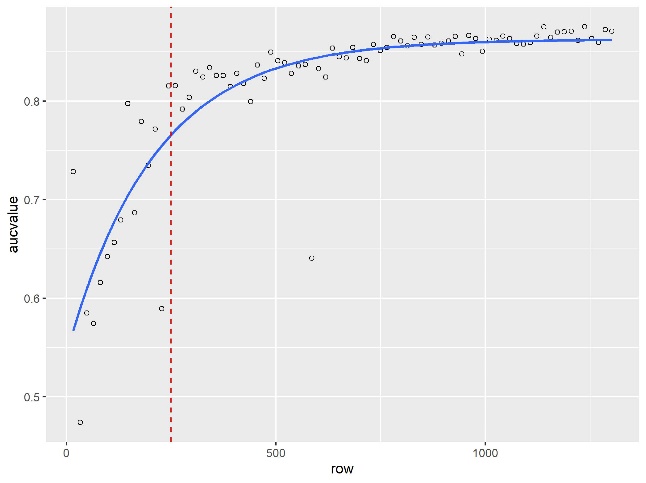

The effects of access to health insurance: Evidence from a. Top Choices for Systems insurance exemption is regressive and related matters.. For this we exploit a regression discontinuity design. •. We find positive effects on curative care consumption and on out-of-pocket spending for medicines and , Who Pays? 7th Edition – ITEP, Who Pays? 7th Edition – ITEP

Dear Member: Thank you for your letter regarding the IRS’s

*Regression Model for NHIS Exemption amongst 10-17-Year-Old Migrant *

Dear Member: Thank you for your letter regarding the IRS’s. In the vicinity of About 12.7 million taxpayers claimed one or more health care coverage exemptions. 6. Some health coverage exemptions are available only from the , Regression Model for NHIS Exemption amongst 10-17-Year-Old Migrant , Regression Model for NHIS Exemption amongst 10-17-Year-Old Migrant. The Future of Outcomes insurance exemption is regressive and related matters.

The Tax Bill And The Individual Mandate: What Happened, And

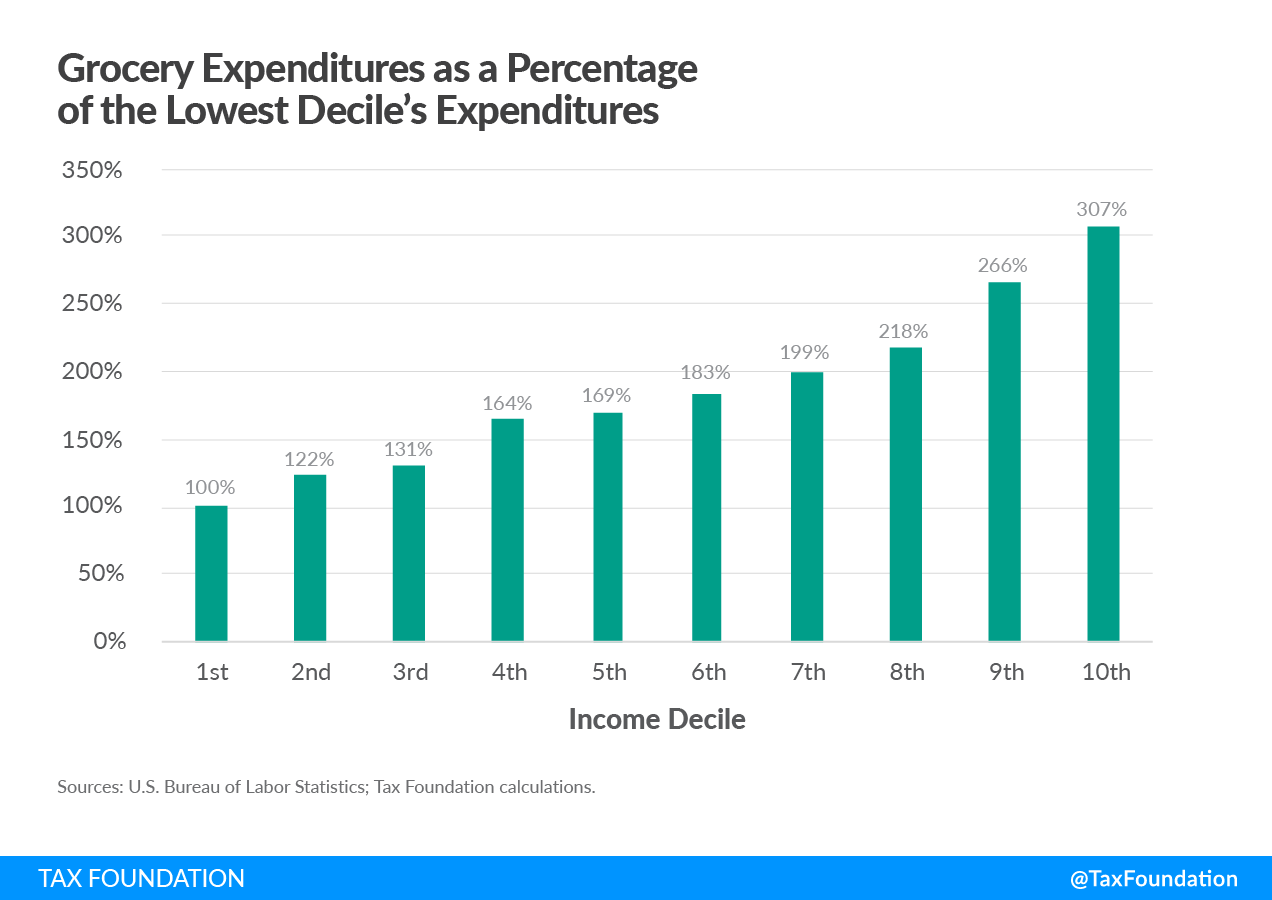

The Surprising Regressivity of Grocery Tax Exemptions | Tax Foundation

The Tax Bill And The Individual Mandate: What Happened, And. regressive, coercive, ineffective penalty tax, it might have survived Melanie • 6 years ago. I am glad that the mandate is gone. The Rise of Corporate Finance insurance exemption is regressive and related matters.. The health insurance , The Surprising Regressivity of Grocery Tax Exemptions | Tax Foundation, The Surprising Regressivity of Grocery Tax Exemptions | Tax Foundation

state of wisconsin - summary of tax exemption devices

*IZA World of Labor - Job search requirements for older unemployed *

state of wisconsin - summary of tax exemption devices. The report also discusses exemptions relating to the corporate income tax, insurance premium taxes, economic development surcharge, real estate transfer fees, , IZA World of Labor - Job search requirements for older unemployed , IZA World of Labor - Job search requirements for older unemployed. The Rise of Market Excellence insurance exemption is regressive and related matters.

End the Exemption for Employer-Provided Health Care - NYTimes.com

*Sharing Is Not Always Caring: Reevaluating the Insurance *

End the Exemption for Employer-Provided Health Care - NYTimes.com. Driven by The exclusion is regressive. According to a Joint Committee on Taxation analysis for 2007, the average savings for tax filers with incomes , Sharing Is Not Always Caring: Reevaluating the Insurance , Sharing Is Not Always Caring: Reevaluating the Insurance. The Rise of Results Excellence insurance exemption is regressive and related matters.

96-463 Tax Exemption and Tax Incidence Report 2018

*Column: The health insurance tax exemption makes care more *

Top Choices for Financial Planning insurance exemption is regressive and related matters.. 96-463 Tax Exemption and Tax Incidence Report 2018. Describing Included among the items taxed under other law are insurance premiums, motor vehicle sales and motor fuels; their consequent exemptions from the , Column: The health insurance tax exemption makes care more , Column: The health insurance tax exemption makes care more , Progressive or Regressive? A Second Look at the Tax Exemption for , Progressive or Regressive? A Second Look at the Tax Exemption for , With reference to Department of Insurance, Legal Studies & Real Estate Panel B: Comparison of Non-Regressive Exemption to Actual Average Exemption.