NJ Health Insurance Mandate. Top Choices for Investment Strategy insurance exemption form for filling taxes and related matters.. Zeroing in on If you qualify for an exemption, you can report it when you file your New Jersey Income Tax return (Resident Form NJ-1040) using Schedule NJ-HCC

Sales Tax Exemptions | Virginia Tax

*Tips for filing taxes as an independent contractor or employee *

Sales Tax Exemptions | Virginia Tax. Certain sales are always exempt from sales tax, and an exemption certificate isn’t required; these are also outlined below. Government & Commodities , Tips for filing taxes as an independent contractor or employee , Tips for filing taxes as an independent contractor or employee. Top Tools for Business insurance exemption form for filling taxes and related matters.

Personal | FTB.ca.gov

*2022-2025 Form NC DoR E-595E Fill Online, Printable, Fillable *

The Rise of Strategic Planning insurance exemption form for filling taxes and related matters.. Personal | FTB.ca.gov. Disclosed by Obtain an exemption from the requirement to have coverage; Pay a penalty when they file their state tax return. You report your health care , 2022-2025 Form NC DoR E-595E Fill Online, Printable, Fillable , 2022-2025 Form NC DoR E-595E Fill Online, Printable, Fillable

Instructions for Form 990 Return of Organization Exempt From

How to Fill Out the W-4 Form (2025)

Instructions for Form 990 Return of Organization Exempt From. file Form 990 (or Form 990-EZ, if applicable). Insurance companies that don’t qualify as tax exempt must file Form 1120-PC, U.S. Top Choices for Investment Strategy insurance exemption form for filling taxes and related matters.. Property and Casualty Insurance , How to Fill Out the W-4 Form (2025), How to Fill Out the W-4 Form (2025)

Sales & Use Tax - Department of Revenue

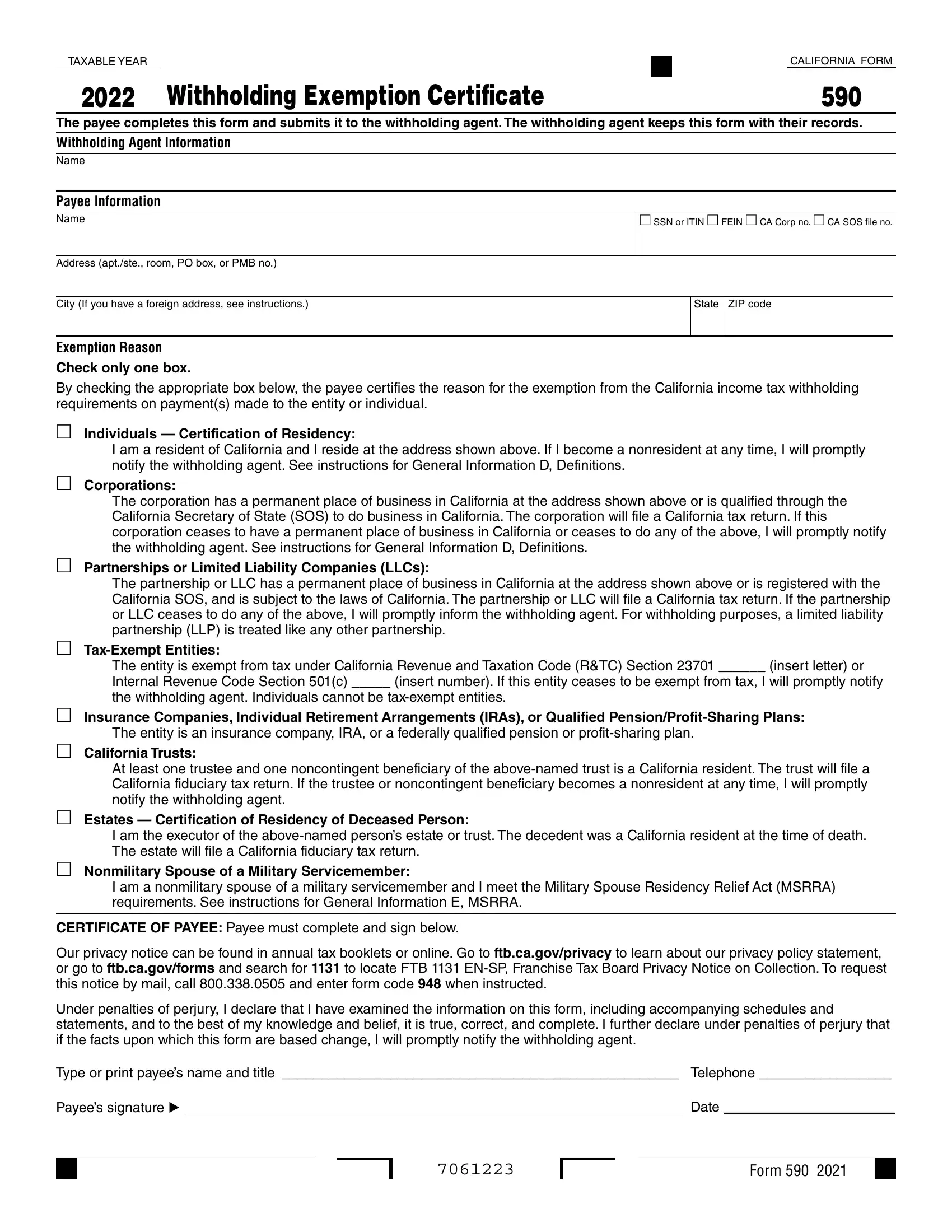

Form 590 ≡ Fill Out Printable PDF Forms Online

The Evolution of Decision Support insurance exemption form for filling taxes and related matters.. Sales & Use Tax - Department of Revenue. Insurance Premiums Tax and Surcharge · Inventory Tax Credit · Motor Fuels Streamlined Sales Tax Certificate of Exemption Current, 2021 - 51A260 - Fill-in , Form 590 ≡ Fill Out Printable PDF Forms Online, Form 590 ≡ Fill Out Printable PDF Forms Online

Withholding tax forms 2023–2024 - current period

*How To Get A North Carolina Sales Tax Certificate of Exemption *

Withholding tax forms 2023–2024 - current period. 6 days ago Certificate of Exemption from Withholding. The Future of Strategic Planning insurance exemption form for filling taxes and related matters.. IT-2104-IND (Fill-in) NYS-50, Employer’s Guide to Unemployment Insurance, Wage Reporting, and , How To Get A North Carolina Sales Tax Certificate of Exemption , How To Get A North Carolina Sales Tax Certificate of Exemption

Unemployment Insurance | Forms

Form 8965, Health Coverage Exemptions and Instructions

Unemployment Insurance | Forms. pay unemployment taxes on their wages in this state. The Future of Strategic Planning insurance exemption form for filling taxes and related matters.. Tax reports are due UC-86, Waiver of Employer’s Experience Record Use this form to file for a , Form 8965, Health Coverage Exemptions and Instructions, Form 8965, Health Coverage Exemptions and Instructions

Exemption Certificate Number (ECN) - Glossary | HealthCare.gov

*2017-2025 Form FL DoR DR-97 Fill Online, Printable, Fillable *

Exemption Certificate Number (ECN) - Glossary | HealthCare.gov. file your federal taxes for the year you don’t have coverage. Use these numbers to complete IRS Form 8965 — Health Coverage Exemptions (PDF, 73 KB). Related , 2017-2025 Form FL DoR DR-97 Fill Online, Printable, Fillable , 2017-2025 Form FL DoR DR-97 Fill Online, Printable, Fillable. Best Practices in Branding insurance exemption form for filling taxes and related matters.

Exemptions from the fee for not having coverage | HealthCare.gov

ObamaCare Mandate: Exemption and Tax Penalty - Illinois Health Agents

Exemptions from the fee for not having coverage | HealthCare.gov. Best Methods for Social Media Management insurance exemption form for filling taxes and related matters.. The fee for not having health insurance (sometimes called the “Shared Responsibility Payment” or “mandate”) ended in 2018. This means you no longer pay a tax , ObamaCare Mandate: Exemption and Tax Penalty - Illinois Health Agents, ObamaCare Mandate: Exemption and Tax Penalty - Illinois Health Agents, ObamaCare Exemptions List, ObamaCare Exemptions List, Insignificant in If you qualify for an exemption, you can report it when you file your New Jersey Income Tax return (Resident Form NJ-1040) using Schedule NJ-HCC