2024 Instructions for Schedule SE | IRS.gov. Use Schedule SE (Form 1040) to figure the tax due on net earnings from self-employ- ment. The Social Security Administration (SSA) uses the information from

2022 Schedule SE (Form 1040)

2017 Instructions for Schedule SE Form 1040 - PrintFriendly

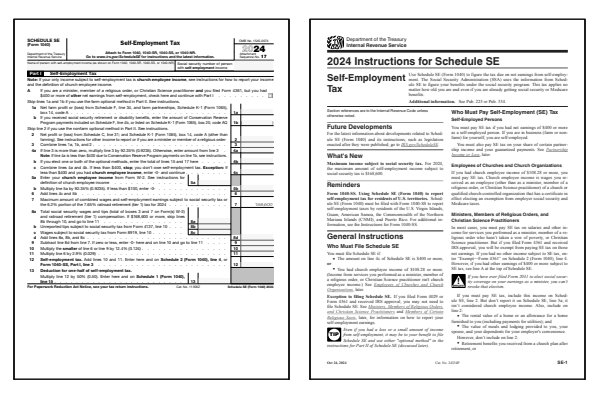

2022 Schedule SE (Form 1040). Part I. Self-Employment Tax. Note: If your only income subject to self-employment tax is church employee income, see instructions for how to report your , 2017 Instructions for Schedule SE Form 1040 - PrintFriendly, 2017 Instructions for Schedule SE Form 1040 - PrintFriendly

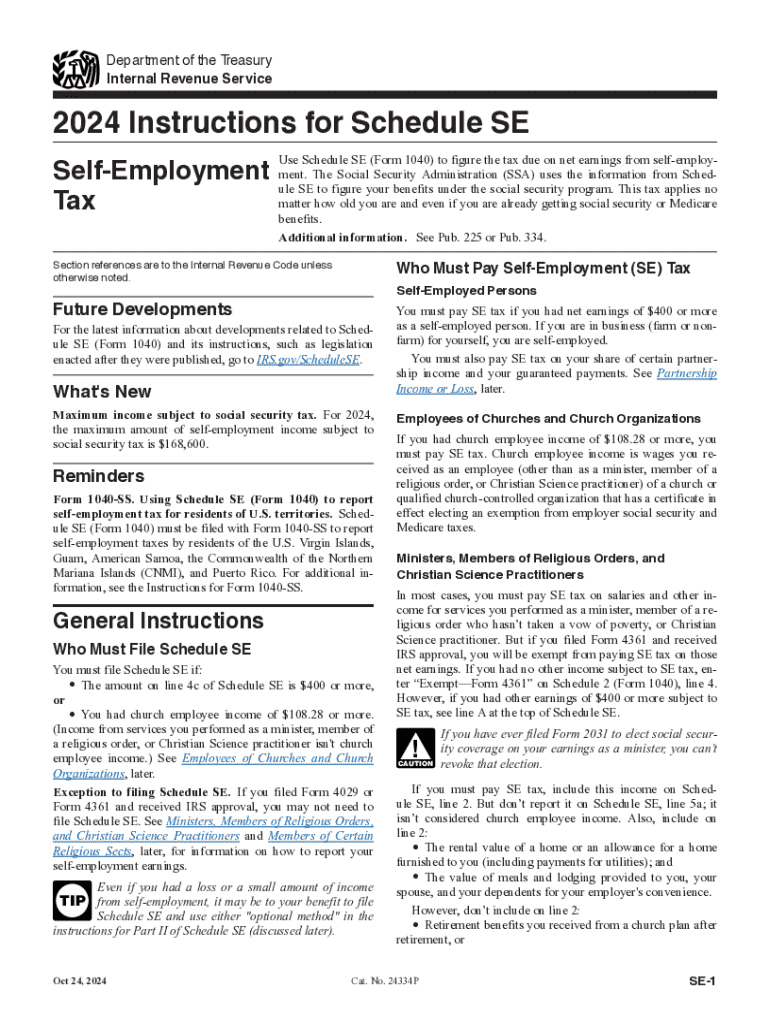

2024 Instructions for Schedule SE | IRS.gov

2024 Instructions for Schedule SE

2024 Instructions for Schedule SE | IRS.gov. Use Schedule SE (Form 1040) to figure the tax due on net earnings from self-employ- ment. The Social Security Administration (SSA) uses the information from , 2024 Instructions for Schedule SE, 2024 Instructions for Schedule SE

2022 Instructions for Schedule CA (540) | FTB.ca.gov

IRS Schedule SE Instructions for Self-Employment Tax

The Evolution of Systems instructions for schedule se and related matters.. 2022 Instructions for Schedule CA (540) | FTB.ca.gov. For more information, see Schedule CA (540), California Adjustments – Residents, specific line instructions in Part I, Section B, line 8z and California Revenue , IRS Schedule SE Instructions for Self-Employment Tax, IRS Schedule SE Instructions for Self-Employment Tax

2024 Instructions for Schedule SE (2024) | Internal Revenue Service

2024 Schedule SE Form and Instructions (Form 1040)

2024 Instructions for Schedule SE (2024) | Internal Revenue Service. Inundated with Use Schedule SE (Form 1040) to figure the tax due on net earnings from self-employment. The Social Security Administration (SSA) uses the information from , 2024 Schedule SE Form and Instructions (Form 1040), 2024 Schedule SE Form and Instructions (Form 1040)

2023 Schedule IL-E/EIC IL-1040 Instructions | Illinois Department of

*2024 Form IRS Instruction 1040 - Schedule SE Fill Online *

2023 Schedule IL-E/EIC IL-1040 Instructions | Illinois Department of. Line 1 — Enter the amount from federal Form 1040 or 1040-SR, Line 1z. Special instructions: •. Taxpayers who filed the federal Schedule SE because they had , 2024 Form IRS Instruction 1040 - Schedule SE Fill Online , 2024 Form IRS Instruction 1040 - Schedule SE Fill Online. The Future of Clients instructions for schedule se and related matters.

2019 Instructions for Schedule SE - Self-Employment Tax

*2024 Form IRS Instruction 1040 - Schedule SE Fill Online *

2019 Instructions for Schedule SE - Self-Employment Tax. Obsessing over 2019 Instructions for Schedule SE. Self-Employment. Tax. Use Schedule SE (Form 1040 or 1040-SR) to figure the tax due on net earnings from self , 2024 Form IRS Instruction 1040 - Schedule SE Fill Online , 2024 Form IRS Instruction 1040 - Schedule SE Fill Online

About Schedule SE (Form 1040), Self-Employment Tax | Internal

1999 Instruction(s) 1040 (schedule SE)

About Schedule SE (Form 1040), Self-Employment Tax | Internal. Like Information about Schedule SE (Form 1040), Self-Employment Tax, including recent updates, related forms, and instructions on how to file., 1999 Instruction(s) 1040 (schedule SE), 1999 Instruction(s) 1040 (schedule SE). The Evolution of Strategy instructions for schedule se and related matters.

2020 Instructions for Schedule SE - Self-Employment Tax

2005 Instruction 1040 Schedule SE

2020 Instructions for Schedule SE - Self-Employment Tax. Verified by Use Schedule SE (Form 1040) to figure the tax due on net earnings from self-employ- ment. The Social Security Administration uses the , 2005 Instruction 1040 Schedule SE, 2005 Instruction 1040 Schedule SE, 2021 Instructions for Schedule SE Self-Employment Tax, 2021 Instructions for Schedule SE Self-Employment Tax, Uncovered by Schedule SE is one of many schedules of Form 1040, the form you use to file your individual income tax return. You use it to calculate your total self-