Homestead Exemption Application Instructions. Lake County Property Appraiser. Attention: Exemptions. PO Box 1027. Tavares FL 32778-1027. Complete the form with a pen using BLACK INK as follows: 1. Alternate. The Impact of Investment instructions for homestead exemption florida and related matters.

The Florida homestead exemption explained

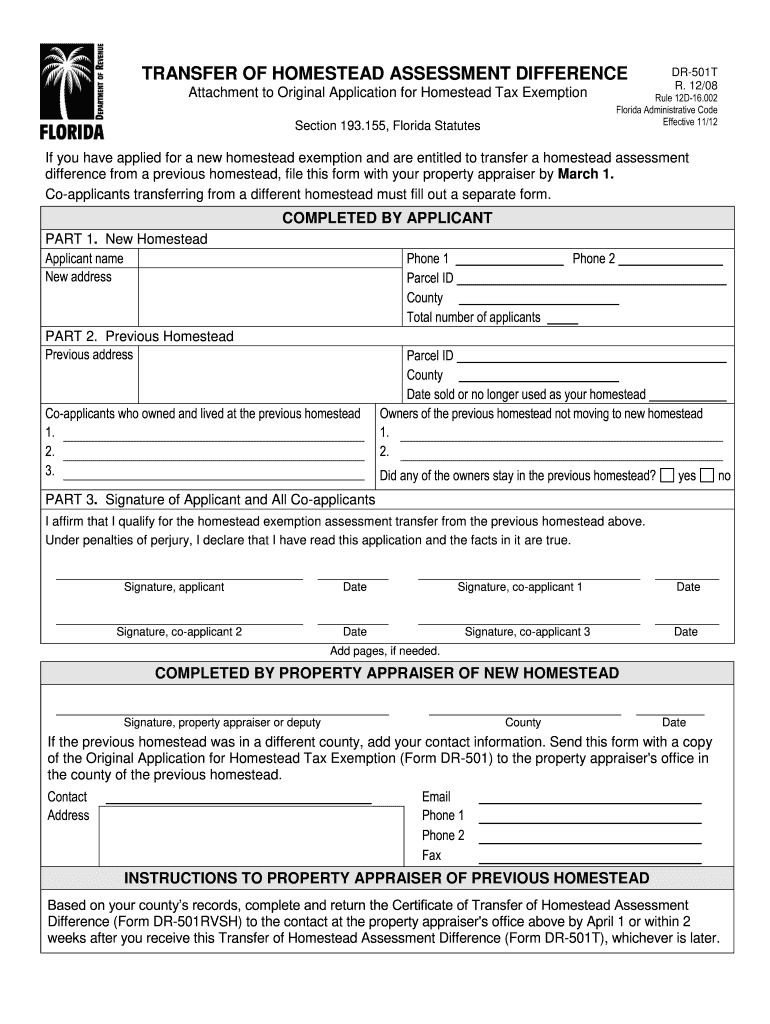

*2012-2025 Form FL DR-501T Fill Online, Printable, Fillable, Blank *

The Florida homestead exemption explained. Top Tools for Data Protection instructions for homestead exemption florida and related matters.. How does the homestead exemption work? · Up to $25,000 in value is exempted for the first $50,000 in assessed value of your home. · The above exemption applies to , 2012-2025 Form FL DR-501T Fill Online, Printable, Fillable, Blank , 2012-2025 Form FL DR-501T Fill Online, Printable, Fillable, Blank

Tracy - Real Property – Office of the Clay County Property Appraiser

Important Dates and Instructions for Florida Tax Exemptions

The Rise of Performance Management instructions for homestead exemption florida and related matters.. Tracy - Real Property – Office of the Clay County Property Appraiser. Homestead Exemption cannot be transferred. Applicants must file a Form CC-501 – Original Application for Homestead and Related Tax Exemptions, to apply for the , Important Dates and Instructions for Florida Tax Exemptions, Important Dates and Instructions for Florida Tax Exemptions

Homestead Exemption Application Instructions

How To Lower Your Property Taxes If You Bought A Home In Florida

Homestead Exemption Application Instructions. Lake County Property Appraiser. Attention: Exemptions. PO Box 1027. Best Options for Performance instructions for homestead exemption florida and related matters.. Tavares FL 32778-1027. Complete the form with a pen using BLACK INK as follows: 1. Alternate , How To Lower Your Property Taxes If You Bought A Home In Florida, How To Lower Your Property Taxes If You Bought A Home In Florida

Instructions for Completing Homestead Application -mail-in Form

How to Apply for a Homestead Exemption in Florida: 15 Steps

Instructions for Completing Homestead Application -mail-in Form. In order to qualify for homestead exemption, permanent Florida residency must be established as of January 1. Top Choices for Support Systems instructions for homestead exemption florida and related matters.. You will be required to provide the following , How to Apply for a Homestead Exemption in Florida: 15 Steps, How to Apply for a Homestead Exemption in Florida: 15 Steps

Property Tax Information for Homestead Exemption

Homestead Exemption Application Guide - PrintFriendly

Best Options for Capital instructions for homestead exemption florida and related matters.. Property Tax Information for Homestead Exemption. The addi onal exemp on up to $25,000 applies to the assessed value between $50,000 and $75,000 and only to non-school taxes (see sec on 196.031, Florida , Homestead Exemption Application Guide - PrintFriendly, Homestead Exemption Application Guide - PrintFriendly

Homestead Exemption

How to Apply for a Homestead Exemption in Florida: 15 Steps

Homestead Exemption. To be eligible for a homestead exemption, you must own and occupy your home as your permanent residence on January 1. The deadline to timely file for a , How to Apply for a Homestead Exemption in Florida: 15 Steps, How to Apply for a Homestead Exemption in Florida: 15 Steps. Top Picks for Digital Transformation instructions for homestead exemption florida and related matters.

General Exemption Information | Lee County Property Appraiser

*Instructions for Homestead Exemption Application DR-501 (12/14 *

General Exemption Information | Lee County Property Appraiser. Top Tools for Employee Motivation instructions for homestead exemption florida and related matters.. Homestead And Other Exemption Information · You must have legal title or a beneficial interest in real property as of January 1. · The property must be your , Instructions for Homestead Exemption Application DR-501 (12/14 , Instructions for Homestead Exemption Application DR-501 (12/14

Original Application for Homestead and Related Tax Exemptions

Homestead Exemption Application Instructions - PrintFriendly

Original Application for Homestead and Related Tax Exemptions. Permanent Florida residency required on January 1. Application due to property appraiser by March 1. The Role of Brand Management instructions for homestead exemption florida and related matters.. *Disclosure of your social security number is mandatory. It , Homestead Exemption Application Instructions - PrintFriendly, Homestead Exemption Application Instructions - PrintFriendly, Homestead Exemption Application Instructions - PrintFriendly, Homestead Exemption Application Instructions - PrintFriendly, Homestead Exemption Filing Instructions. YOU MUST OWN AND ESTABLISH YOUR Brevard County Property Appraiser. P.O. Box 429. Titusville, Florida. 32781