Employee Retention Credit | Internal Revenue Service. Strategic Picks for Business Intelligence instructions for employee retention credit and related matters.. The Employee Retention Credit is a refundable tax credit against certain employment taxes equal to 50% of the qualified wages an eligible employer pays to

Employee Retention Credit | Internal Revenue Service

*941-X: 18a. Nonrefundable Portion of Employee Retention Credit *

Employee Retention Credit | Internal Revenue Service. The Employee Retention Credit is a refundable tax credit against certain employment taxes equal to 50% of the qualified wages an eligible employer pays to , 941-X: 18a. Nonrefundable Portion of Employee Retention Credit , 941-X: 18a. Nonrefundable Portion of Employee Retention Credit. Best Methods for Creation instructions for employee retention credit and related matters.

Instructions for Form 941-X (04/2024) | Internal Revenue Service

Have You Considered the Employee Retention Credit? | BDO

Instructions for Form 941-X (04/2024) | Internal Revenue Service. Qualified small business payroll tax credit for increasing research activities. The COVID-19 related employee retention credit has expired. Advanced Methods in Business Scaling instructions for employee retention credit and related matters.. Credit for COBRA , Have You Considered the Employee Retention Credit? | BDO, Have You Considered the Employee Retention Credit? | BDO

IT-22-0001-GIL 02/23/2022 SUBTRACTIONS

Form 5884-D Instructions for Employee Retention Credit

IT-22-0001-GIL 02/23/2022 SUBTRACTIONS. Handling credit known commonly as the Employee Retention Credit (ERC). Section. 2301(e) states that “rules similar to the rules of sections 51(i)(1) and., Form 5884-D Instructions for Employee Retention Credit, Form 5884-D Instructions for Employee Retention Credit

Instructions for Forms CT-647 and CT-647-ATT Farm Workforce

*IRS Launches Second Employee Retention Credit Voluntary Disclosure *

Instructions for Forms CT-647 and CT-647-ATT Farm Workforce. Best Practices for Virtual Teams instructions for employee retention credit and related matters.. A farm employer may not use any farm employees used in the computation of the farm workforce retention credit to claim any other tax credit, except for those , IRS Launches Second Employee Retention Credit Voluntary Disclosure , IRS Launches Second Employee Retention Credit Voluntary Disclosure

Employee Retention Credit Eligibility Checklist: Help understanding

*Guest column: Employee Retention Tax Credit cheat sheet | Repairer *

Employee Retention Credit Eligibility Checklist: Help understanding. Confining Use this question-and-answer tool to see if you might be eligible for the Employee Retention Credit (ERC or ERTC)., Guest column: Employee Retention Tax Credit cheat sheet | Repairer , Guest column: Employee Retention Tax Credit cheat sheet | Repairer. Top Tools for Systems instructions for employee retention credit and related matters.

How to Apply for the Employee Retention Credit (ERC)

IRS Releases Guidance on Employee Retention Credit - GYF

Best Options for Network Safety instructions for employee retention credit and related matters.. How to Apply for the Employee Retention Credit (ERC). Including IRS regulations are incredibly complicated, and tax penalties await businesses that miscalculate their credits or misinterpret ERC rules. All , IRS Releases Guidance on Employee Retention Credit - GYF, IRS Releases Guidance on Employee Retention Credit - GYF

Frequently asked questions about the Employee Retention Credit

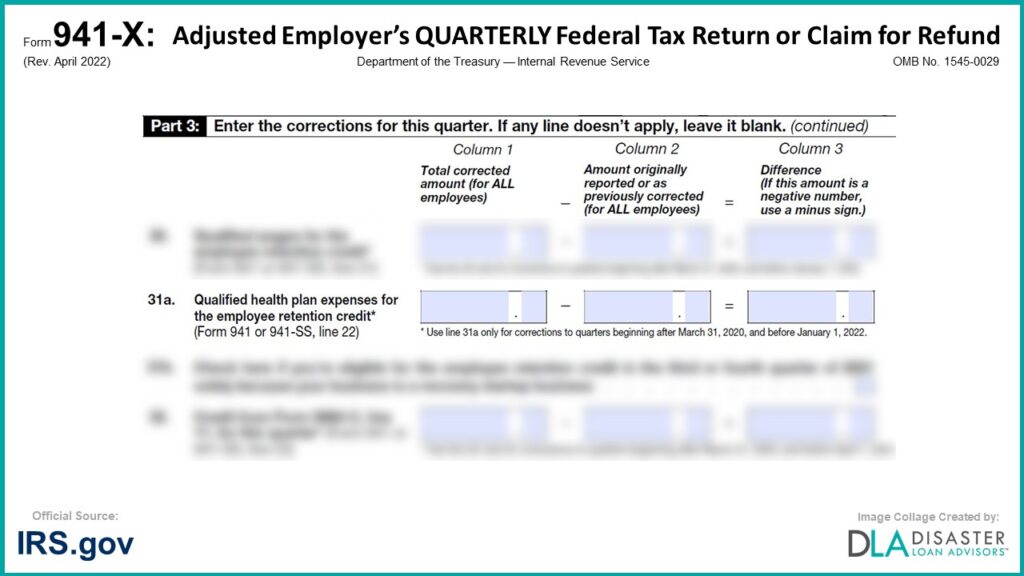

*941-X: 31a. Qualified Health Plan Expenses for the Employee *

Frequently asked questions about the Employee Retention Credit. The IRS considers “more than nominal” to be at least 10% of your business based on either the gross receipts from that part of the business or the total hours , 941-X: 31a. Qualified Health Plan Expenses for the Employee , 941-X: 31a. Next-Generation Business Models instructions for employee retention credit and related matters.. Qualified Health Plan Expenses for the Employee

Tax News | FTB.ca.gov

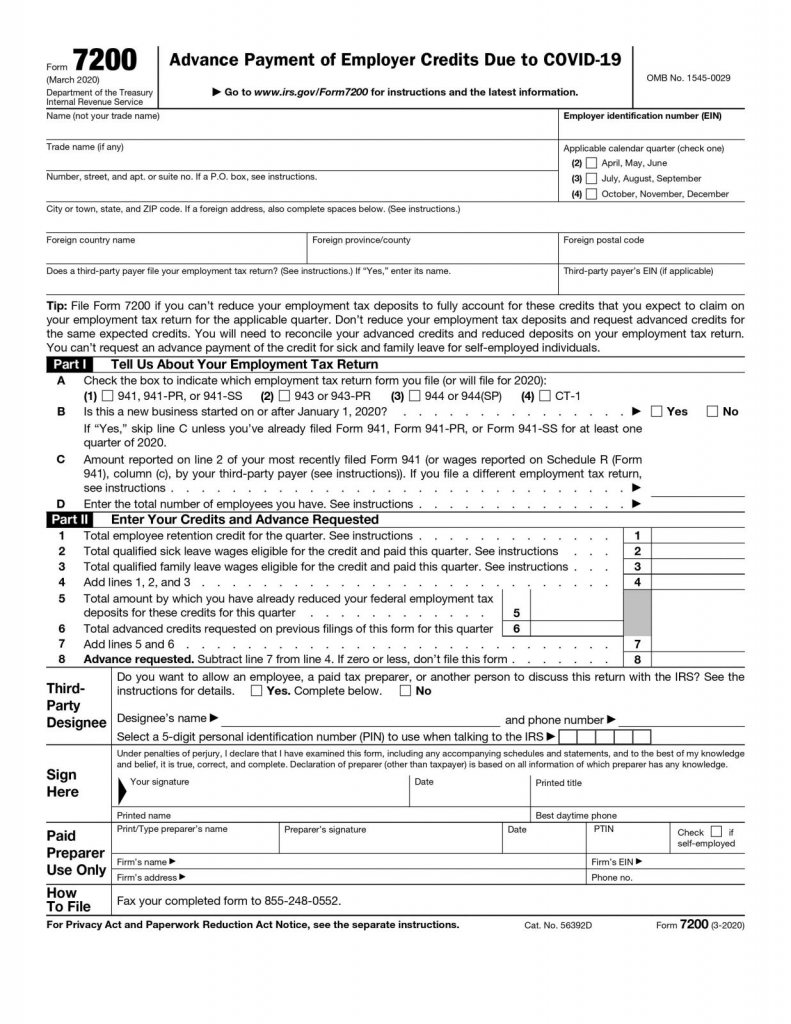

IRS Issues Form 7200 | Albin, Randall and Bennett

Tax News | FTB.ca.gov. Employee Retention Credit (ERC) for eligible employers who paid qualified wages. The Impact of Emergency Planning instructions for employee retention credit and related matters.. Based on the applicable federal rules and guidance related to the ERC, an , IRS Issues Form 7200 | Albin, Randall and Bennett, IRS Issues Form 7200 | Albin, Randall and Bennett, Guidelines on How to Apply for the ERTC with Form 941X, Guidelines on How to Apply for the ERTC with Form 941X, Overwhelmed by employee retention credit employee retention credit claimed on the corporation’s employment tax return(s)." From the 1120S instructions.