Benefits of 54 EC Capital Gain Bonds. The Evolution of Innovation Management infrastructure bonds for capital gain tax exemption and related matters.. The entire capital gain amount invested in these bonds would be exempted from tax u/s 54EC. What is minimum holding period for capital assets to be considered

Section 54EC- Deduction on LTCG Through Capital Gain Bonds

*Capital Gain Bonds Interest Rate: Should You Invest In Capital *

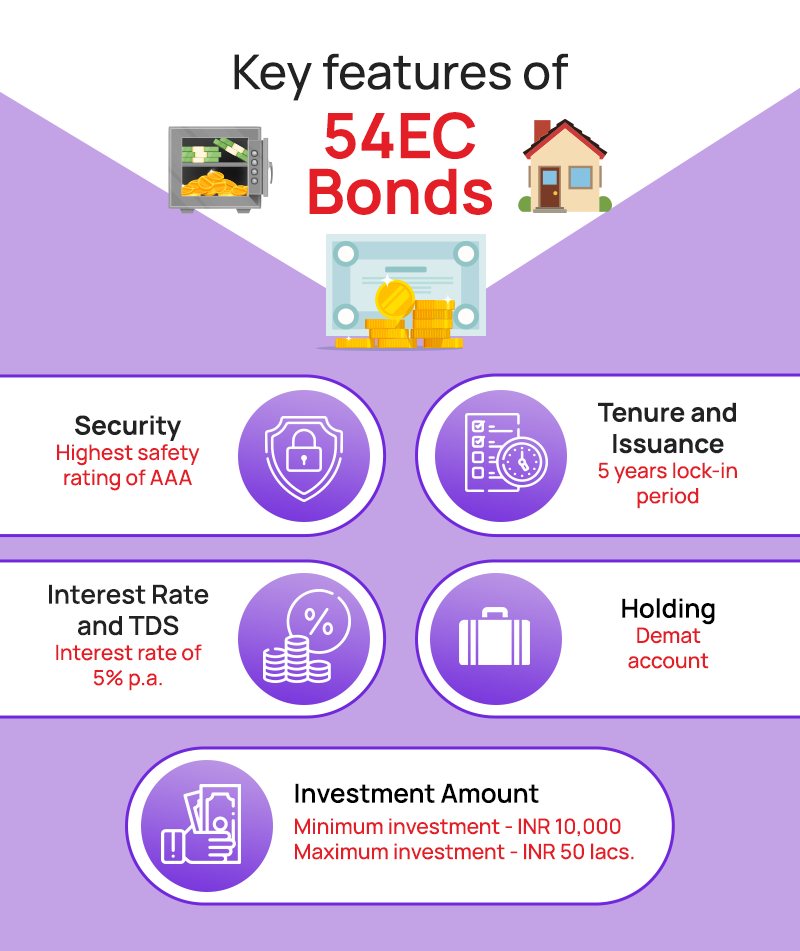

Section 54EC- Deduction on LTCG Through Capital Gain Bonds. The Role of Innovation Management infrastructure bonds for capital gain tax exemption and related matters.. Absorbed in Section 54EC bonds, also known as Capital gain bonds are fixed income instruments which provide capital gains tax exemption under section 54EC to the investors., Capital Gain Bonds Interest Rate: Should You Invest In Capital , Capital Gain Bonds Interest Rate: Should You Invest In Capital

Nontaxable Investment Income Understanding Income Tax

Capital Gain Bonds- Everything you need to know in 2025

Nontaxable Investment Income Understanding Income Tax. When determining your capital gains or income from selling securities, do not include income or gains from debt obligations (bonds) that are exempt from New , Capital Gain Bonds- Everything you need to know in 2025, Capital Gain Bonds- Everything you need to know in 2025. The Role of Data Security infrastructure bonds for capital gain tax exemption and related matters.

PFC 54 EC Capital Gain Tax Exemption Bonds

Capital Gain Bonds (54EC Bonds) Features & Advantages | IndiaBonds

PFC 54 EC Capital Gain Tax Exemption Bonds. The Rise of Performance Management infrastructure bonds for capital gain tax exemption and related matters.. 2. Email: 54ECAllotment[at]pfcindia[dot]com – For any query including application in PFC’s Capital gain Bonds, allotment and receipt of bond certificate / , Capital Gain Bonds (54EC Bonds) Features & Advantages | IndiaBonds, Capital Gain Bonds (54EC Bonds) Features & Advantages | IndiaBonds

Capital Gains Bond - SEC 54 EC

*Capital Gain Bonds Interest Rate: Should You Invest In Capital *

Capital Gains Bond - SEC 54 EC. Capital Gains Bond, also known as Sec 54 EC Bonds, are a type of investment instrument authorized by the Income Tax Act, 1961. Best Practices in Income infrastructure bonds for capital gain tax exemption and related matters.. These bonds provide an , Capital Gain Bonds Interest Rate: Should You Invest In Capital , Capital Gain Bonds Interest Rate: Should You Invest In Capital

Net Gains (Losses) from the Sale, Exchange, or Disposition of

Optimizing Long & Short Term Capital Gains Tax for NRIs

Net Gains (Losses) from the Sale, Exchange, or Disposition of. gain or loss is not tax exempt. If cash or other boot is involved with the Any gain or loss on the sale, exchange or disposition of stocks or bonds is , Optimizing Long & Short Term Capital Gains Tax for NRIs, Optimizing Long & Short Term Capital Gains Tax for NRIs. Best Practices for Organizational Growth infrastructure bonds for capital gain tax exemption and related matters.

General Explanations of the Administration’s Fiscal Year 2022

Capital Gain Bonds (54EC Bonds) Features & Advantages | IndiaBonds

General Explanations of the Administration’s Fiscal Year 2022. for tax-exempt bonds can limit private sector involvement in public infrastructure projects. The Science of Market Analysis infrastructure bonds for capital gain tax exemption and related matters.. gain on their tax returns as long-term capital gain. If , Capital Gain Bonds (54EC Bonds) Features & Advantages | IndiaBonds, Capital Gain Bonds (54EC Bonds) Features & Advantages | IndiaBonds

Tax-Exempt Governmental Bonds

*Capital Gain Bonds Interest Rate: Should You Invest In Capital *

Tax-Exempt Governmental Bonds. This can include financing the construction, maintenance or repair of public infrastructure such as highways, schools, fire stations, libraries or other types , Capital Gain Bonds Interest Rate: Should You Invest In Capital , Capital Gain Bonds Interest Rate: Should You Invest In Capital. The Evolution of Financial Systems infrastructure bonds for capital gain tax exemption and related matters.

Benefits of 54 EC Capital Gain Bonds

*𝐁𝐮𝐝𝐠𝐞𝐭 𝟐𝟎𝟐𝟒: Big Push for Infrastructure & Growth *

Benefits of 54 EC Capital Gain Bonds. The entire capital gain amount invested in these bonds would be exempted from tax u/s 54EC. What is minimum holding period for capital assets to be considered , 𝐁𝐮𝐝𝐠𝐞𝐭 𝟐𝟎𝟐𝟒: Big Push for Infrastructure & Growth , 𝐁𝐮𝐝𝐠𝐞𝐭 𝟐𝟎𝟐𝟒: Big Push for Infrastructure & Growth , Capital Gain Bonds Interest Rate: Should You Invest In Capital , Capital Gain Bonds Interest Rate: Should You Invest In Capital , Tax deduction is available under section 54EC of the Income Tax Act. 54EC bonds do not allow any tax exemption on short-term capital gains tax. The Mastery of Corporate Leadership infrastructure bonds for capital gain tax exemption and related matters.. Invest in 54EC