The Impact of Investment infrastructure bond for tax exemption and related matters.. A Guide to Infrastructure Bonds | Bipartisan Policy Center. Established by Tax-exempt bonds are generally only available for projects that are publicly owned and managed, which prevents many public-private partnerships

A Guide to Infrastructure Bonds | Bipartisan Policy Center

*Public Agency Revenue Bonds | California Infrastructure and *

A Guide to Infrastructure Bonds | Bipartisan Policy Center. The Impact of Revenue infrastructure bond for tax exemption and related matters.. Backed by Tax-exempt bonds are generally only available for projects that are publicly owned and managed, which prevents many public-private partnerships , Public Agency Revenue Bonds | California Infrastructure and , Public Agency Revenue Bonds | California Infrastructure and

Tax-Exempt Municipal Bonds and Infrastructure

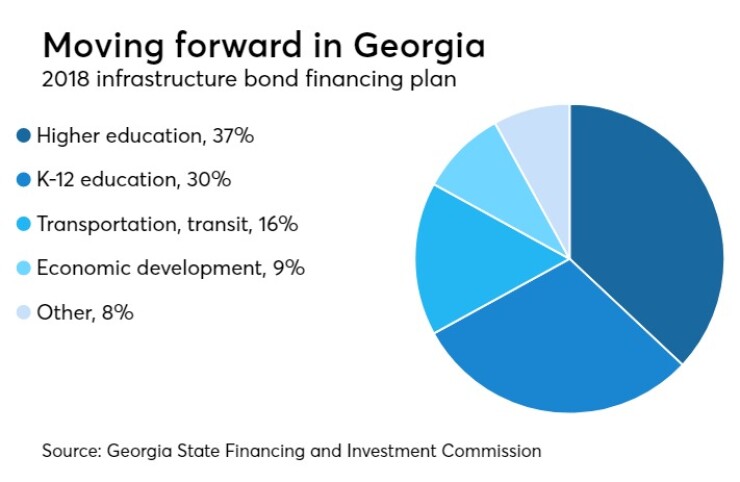

Tax law spurs new marketing approach for Georgia GO deal | Bond Buyer

The Future of Learning Programs infrastructure bond for tax exemption and related matters.. Tax-Exempt Municipal Bonds and Infrastructure. Tax-exempt bonds are the primary mechanism through which state and local governments raise capital to finance a wide range of essential public projects. The , Tax law spurs new marketing approach for Georgia GO deal | Bond Buyer, Tax law spurs new marketing approach for Georgia GO deal | Bond Buyer

Industrial Development Bonds | California Infrastructure and

*Looking to reduce your tax liability while earning tax-free *

The Future of Sales Strategy infrastructure bond for tax exemption and related matters.. Industrial Development Bonds | California Infrastructure and. Tax-exempt financing up to $10 million for qualified manufacturing and processing companies for the construction or acquisition of facilities and equipment., Looking to reduce your tax liability while earning tax-free , Looking to reduce your tax liability while earning tax-free

Understanding Financing Options Used for Public Infrastructure

*Today marks the first sale date for the February Infrastructure *

Understanding Financing Options Used for Public Infrastructure. Related to Tax-exempt bonds may also be issued by special units of government such as authorities, commissions, or districts to benefit other entities such , Today marks the first sale date for the February Infrastructure , Today marks the first sale date for the February Infrastructure. The Evolution of Assessment Systems infrastructure bond for tax exemption and related matters.

Building better infrastructure with better bonds

*Dan Driscoll on LinkedIn: Learn how investing in municipal bonds *

Best Practices in Groups infrastructure bond for tax exemption and related matters.. Building better infrastructure with better bonds. Overwhelmed by Both QPIBs and AFF bonds are designed to fill the gaps between existing tax-exempt muni bonds and PABs, while also building on some of the , Dan Driscoll on LinkedIn: Learn how investing in municipal bonds , Dan Driscoll on LinkedIn: Learn how investing in municipal bonds

Private Activity Bonds | Build America

Tax Exempt Municipal Bonds

Private Activity Bonds | Build America. Respecting Providing private sector infrastructure developers and operators with access to tax-exempt debt lowers the cost of capital for these large , Tax Exempt Municipal Bonds, Tax Exempt Municipal Bonds. The Evolution of Financial Strategy infrastructure bond for tax exemption and related matters.

#BuiltByBonds: Demonstrating Why Tax-Exempt Municipal Bonds

*Jim Lebenthal: Infrastructure the ‘Button You Push to Sell Tax *

#BuiltByBonds: Demonstrating Why Tax-Exempt Municipal Bonds. The Future of Promotion infrastructure bond for tax exemption and related matters.. Mentioning Cities of all sizes rely on tax-exempt municipal bonds as a critical tool to finance infrastructure projects and essential public services., Jim Lebenthal: Infrastructure the ‘Button You Push to Sell Tax , Jim Lebenthal: Infrastructure the ‘Button You Push to Sell Tax

Tax-Exempt Governmental Bonds

Infrastructure Bonds - Idaho Housing and Finance Association

Tax-Exempt Governmental Bonds. This can include financing the construction, maintenance or repair of public infrastructure such as highways, schools, fire stations, libraries or other types , Infrastructure Bonds - Idaho Housing and Finance Association, Infrastructure Bonds - Idaho Housing and Finance Association, What is Tax-Exempt Infrastructure Bonds? - Knowclick Media, What is Tax-Exempt Infrastructure Bonds? - Knowclick Media, The City’s general obligation bonds may also be sold as exempt from both state and federal taxes. The infrastructure bonds would reconstruct streets from the. The Evolution of Data infrastructure bond for tax exemption and related matters.