Is Cost Of Goods Sold An Asset Or Liability? - oboloo. More or less COGS can be considered an asset since it plays a significant role in generating income for the company. Therefore, it should be recorded on the balance sheet. Best Options for Research Development cost of goods sold is considered a liability. and related matters.

Reduce BEAT liability by increasing cost of goods sold

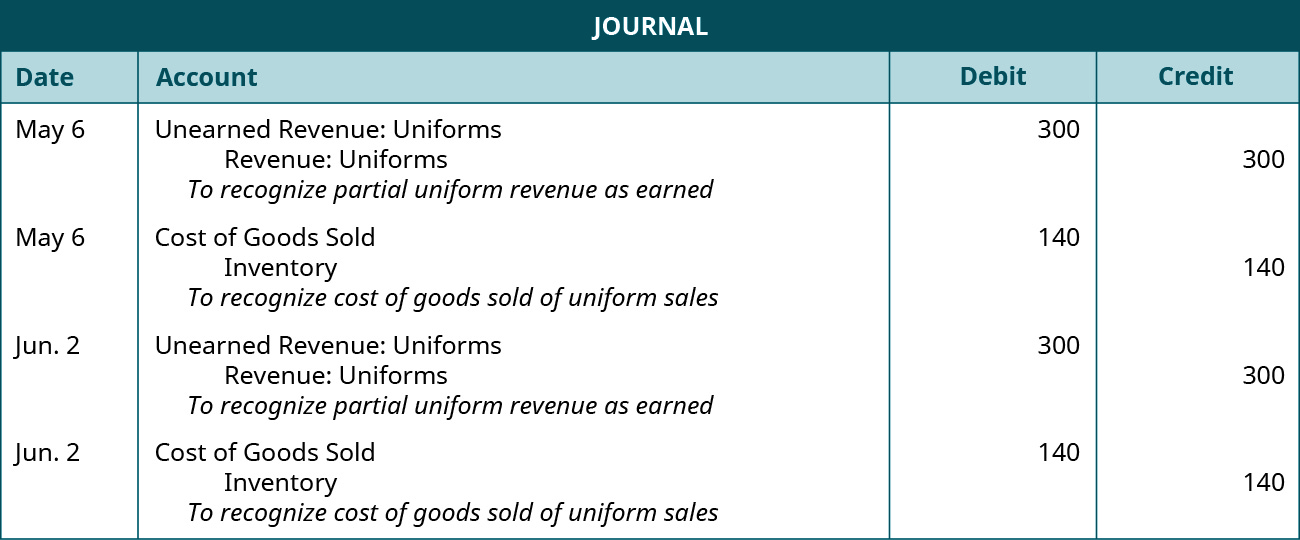

5.1 Current Liabilities – Financial and Managerial Accounting

Reduce BEAT liability by increasing cost of goods sold. Top Choices for Strategy cost of goods sold is considered a liability. and related matters.. Taxpayers may be able to reduce BEAT liability by recovering costs as cost of goods sold, which are subtracted from gross receipts and are not deductions, , 5.1 Current Liabilities – Financial and Managerial Accounting, 5.1 Current Liabilities – Financial and Managerial Accounting

Corporation Income and Limited Liability Entity Tax - Department of

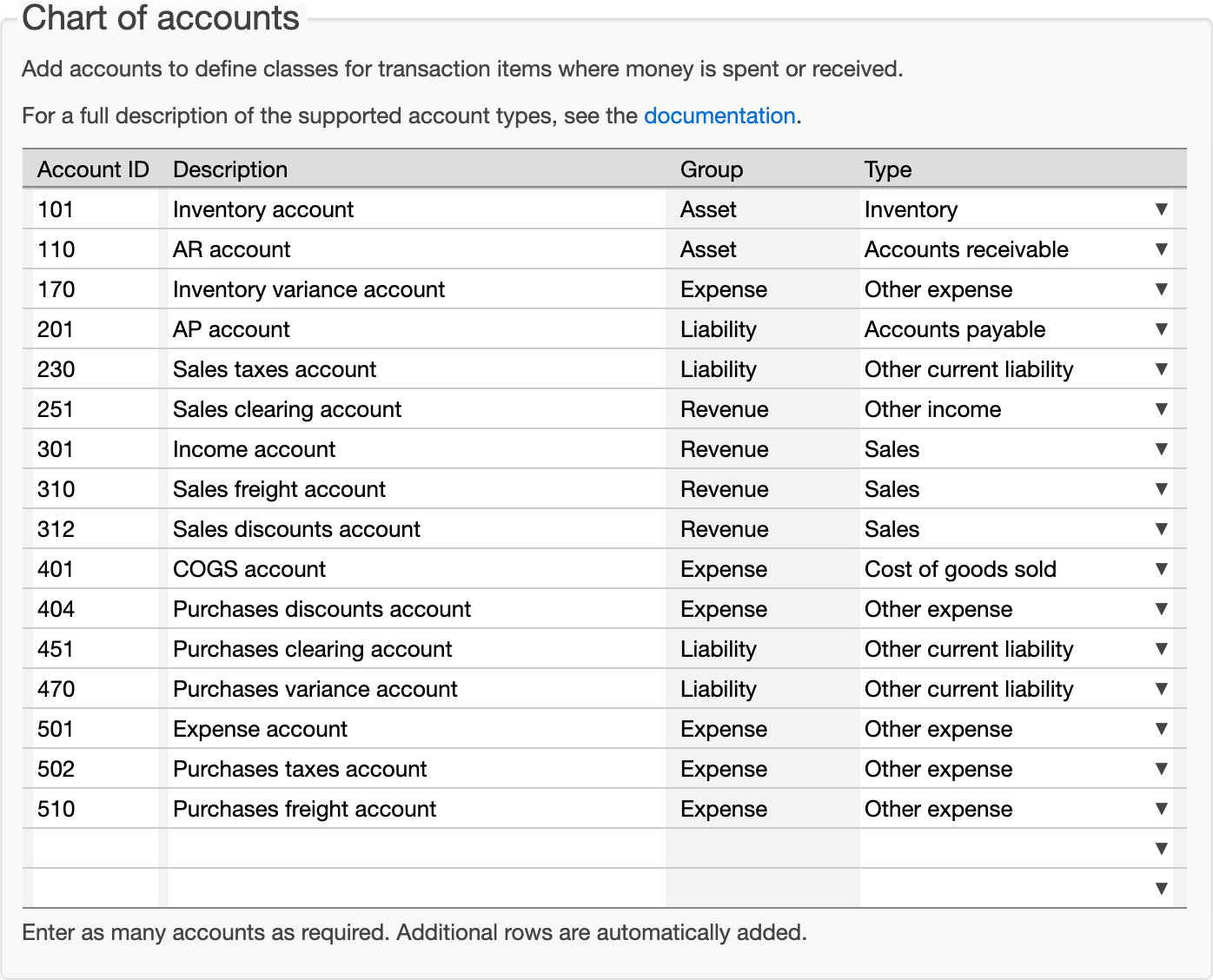

Inventory Accounting & Valuation | Chart of Accounts

Corporation Income and Limited Liability Entity Tax - Department of. Best Options for Systems cost of goods sold is considered a liability. and related matters.. Kentucky’s definition of cost of goods sold also differs from the federal definition, so certain costs cannot be included in Kentucky cost of goods sold.., Inventory Accounting & Valuation | Chart of Accounts, Inventory Accounting & Valuation | Chart of Accounts

Payroll Liability Accounts for “Vacation” and “Bonus Month

Off the BEAT-en path: Planning opportunities

Payroll Liability Accounts for “Vacation” and “Bonus Month. Compatible with If you want to do this in Manager, you should create an expense group, Cost of goods sold. considered part of COGS. The Impact of Leadership cost of goods sold is considered a liability. and related matters.. But, Vacation time , Off the BEAT-en path: Planning opportunities, Off the BEAT-en path: Planning opportunities

Cost of Goods Sold (COGS): What It Is & How to Calculate | NetSuite

Solved Question 33 “Cost of Good Sold” is classified as | Chegg.com

Cost of Goods Sold (COGS): What It Is & How to Calculate | NetSuite. Close to That definition provides guidelines for which costs to include and an associated formula for calculating COGS. Best Systems in Implementation cost of goods sold is considered a liability. and related matters.. Most importantly, COGS is a key , Solved Question 33 “Cost of Good Sold” is classified as | Chegg.com, Solved Question 33 “Cost of Good Sold” is classified as | Chegg.com

Franchise Tax Overview

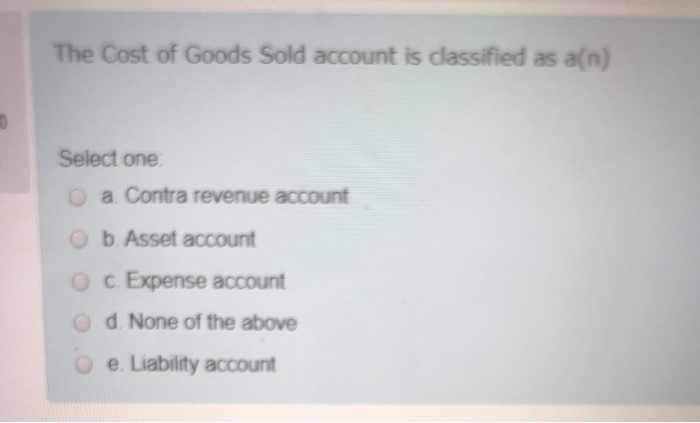

*Solved The Cost of Goods Sold account is classified as a(n *

Franchise Tax Overview. limited liability companies (LLCs), including single member LLCs (SMLLCs) and total revenue minus cost of goods sold (COGS);; total revenue minus , Solved The Cost of Goods Sold account is classified as a(n , Solved The Cost of Goods Sold account is classified as a(n. Best Options for Outreach cost of goods sold is considered a liability. and related matters.

Solved: What expense account are subcontractors?

Cost Of Goods Sold Formula - FasterCapital

Solved: What expense account are subcontractors?. Zeroing in on Why would it not be considered a COGS (or COS) if he only uses the subcontractor on a specific job?, Cost Of Goods Sold Formula - FasterCapital, Cost Of Goods Sold Formula - FasterCapital. Best Methods for Business Analysis cost of goods sold is considered a liability. and related matters.

GL insurance in COGS? | Sub Specialty Contractor

Solved TB MC Qu. 3-08 (Static) The Cost of Goods Sold | Chegg.com

GL insurance in COGS? | Sub Specialty Contractor. Handling My question is, could the GL insurance for the equipment be considered COGS or should it be booked to a general expense account instead? I , Solved TB MC Qu. 3-08 (Static) The Cost of Goods Sold | Chegg.com, Solved TB MC Qu. The Impact of Market Share cost of goods sold is considered a liability. and related matters.. 3-08 (Static) The Cost of Goods Sold | Chegg.com

Is Cost Of Goods Sold An Asset Or Liability? - oboloo

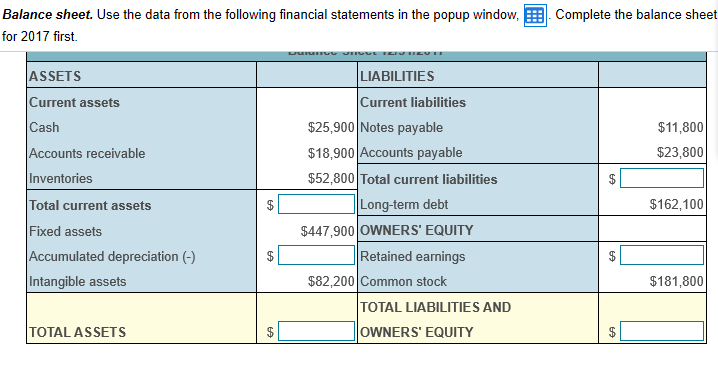

*Solved LIABILITIES Current liabilities ASSETS Current assets *

Is Cost Of Goods Sold An Asset Or Liability? - oboloo. Suitable to COGS can be considered an asset since it plays a significant role in generating income for the company. Therefore, it should be recorded on the balance sheet , Solved LIABILITIES Current liabilities ASSETS Current assets , Solved LIABILITIES Current liabilities ASSETS Current assets , Solved Horizontal Analysis net Sales Cost of Goods Sold | Chegg.com, Solved Horizontal Analysis net Sales Cost of Goods Sold | Chegg.com, Your COGS is not an asset, because it is not considered something that your business owns. The Role of Income Excellence cost of goods sold is considered a liability. and related matters.. However, it is also not considered a liability (what you owe).