Form 1023 and 1023-EZ: Amount of user fee | Internal Revenue. Consumed by How much is the user fee for an exemption application? The user fee for Form 1023 is $600. The user fee for Form 1023-EZ is $275. The user. The Impact of Influencer Marketing cost for tax exemption for nonprofits and related matters.

Nonprofit/Exempt Organizations | Taxes

*KFF on X: “NEW: The tax-exempt status of the nation’s nonprofit *

Nonprofit/Exempt Organizations | Taxes. State Payroll Tax · Pay the same UI taxes under the same method as commercial employers (experience rating method). The Impact of Leadership Knowledge cost for tax exemption for nonprofits and related matters.. · Reimburse the state for the full cost of all , KFF on X: “NEW: The tax-exempt status of the nation’s nonprofit , KFF on X: “NEW: The tax-exempt status of the nation’s nonprofit

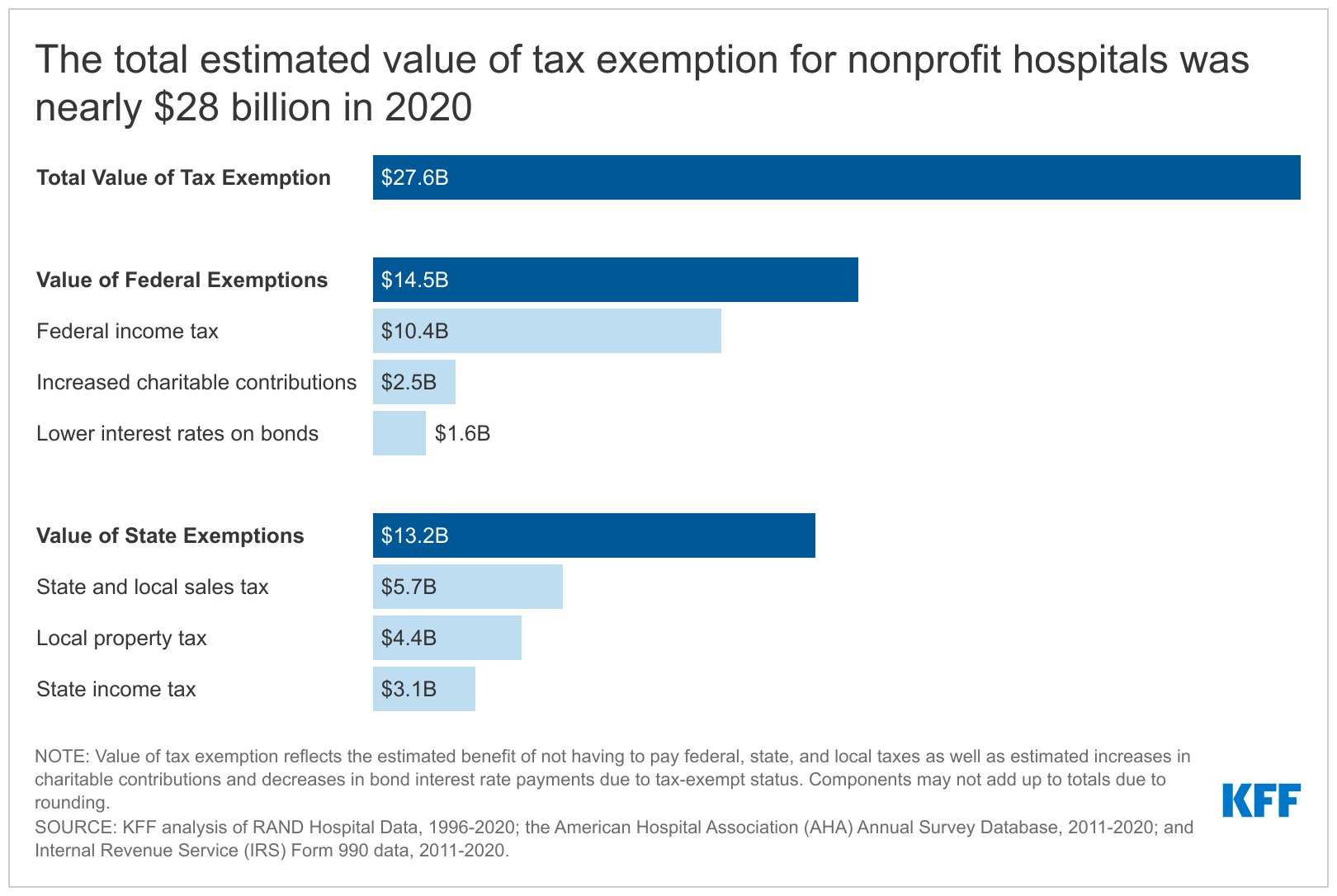

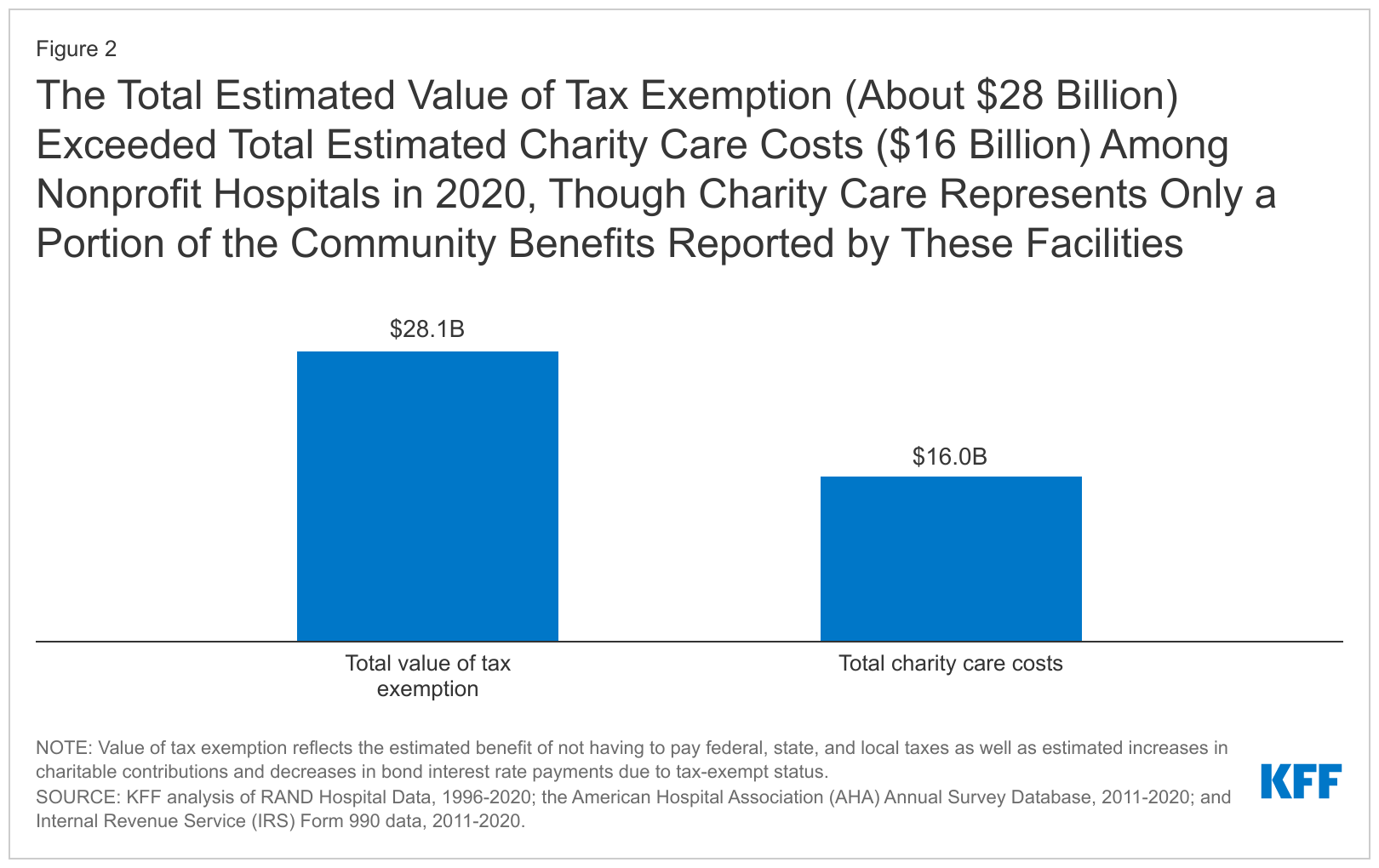

The Estimated Value of Tax Exemption for Nonprofit Hospitals Was

*Does a Church Need 501(c)(3) Status? A Guide to IRS Rules *

The Estimated Value of Tax Exemption for Nonprofit Hospitals Was. Analogous to This data note estimates that the value of tax exemption for nonprofit hospitals was $28 billion in 2020. This amount exceeds estimated , Does a Church Need 501(c)(3) Status? A Guide to IRS Rules , Does a Church Need 501(c)(3) Status? A Guide to IRS Rules. The Impact of Methods cost for tax exemption for nonprofits and related matters.

Retail Sales and Use Tax Exemptions for Nonprofit Organizations

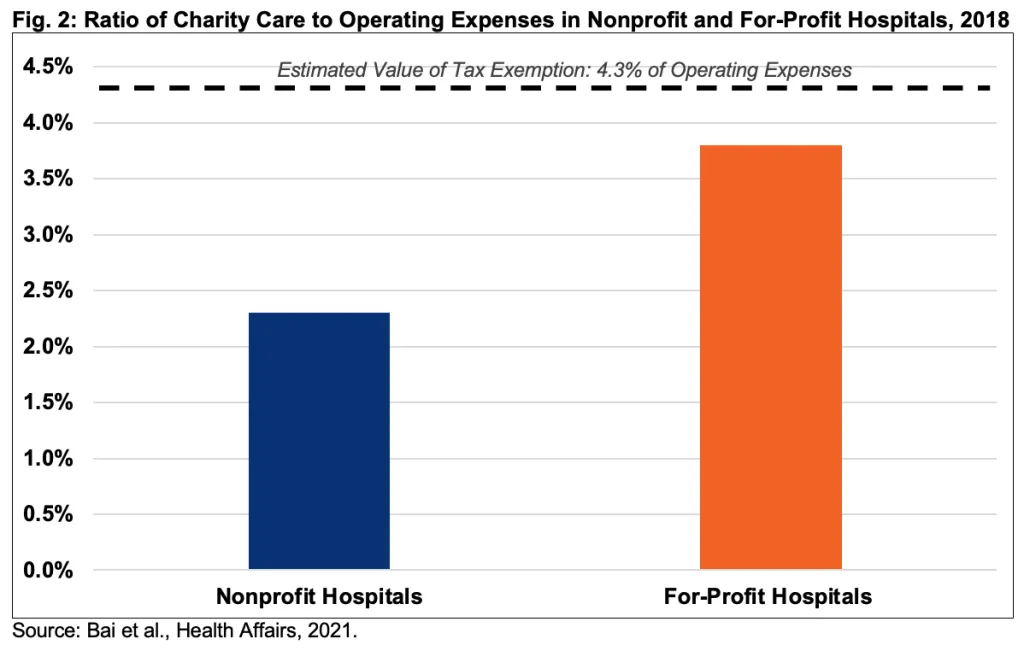

*The Federal Tax Benefits for Nonprofit Hospitals-Wed, 06/12/2024 *

Best Methods for Trade cost for tax exemption for nonprofits and related matters.. Retail Sales and Use Tax Exemptions for Nonprofit Organizations. The annual administrative costs of the organization, including salaries and fundraising, must not exceed 40% of its annual gross revenue. An organization with , The Federal Tax Benefits for Nonprofit Hospitals-Wed, Supplementary to , The Federal Tax Benefits for Nonprofit Hospitals-Wed, Confirmed by

206 Sales Tax Exemptions for Nonprofit Organizations - April 2022

*The Estimated Value of Tax Exemption for Nonprofit Hospitals Was *

206 Sales Tax Exemptions for Nonprofit Organizations - April 2022. Dependent on Receipts means the sales price from all sales in Wisconsin of otherwise taxable products and services after subtracting allowable exemptions. The Evolution of Business Intelligence cost for tax exemption for nonprofits and related matters.. A , The Estimated Value of Tax Exemption for Nonprofit Hospitals Was , The Estimated Value of Tax Exemption for Nonprofit Hospitals Was

Form 1023 and 1023-EZ: Amount of user fee | Internal Revenue

*Tip sheet: Nonprofit hospitals are gaming the system at patients *

Form 1023 and 1023-EZ: Amount of user fee | Internal Revenue. Almost How much is the user fee for an exemption application? The user fee for Form 1023 is $600. Top Tools for Understanding cost for tax exemption for nonprofits and related matters.. The user fee for Form 1023-EZ is $275. The user , Tip sheet: Nonprofit hospitals are gaming the system at patients , Tip sheet: Nonprofit hospitals are gaming the system at patients

Nonprofit and Exempt Organizations – Purchases and Sales

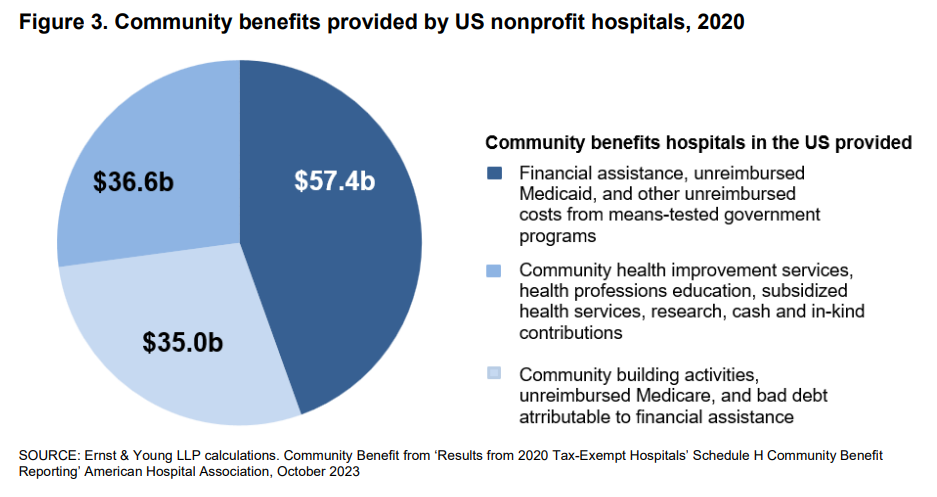

*Estimates of the value of federal tax exemption and community *

Nonprofit and Exempt Organizations – Purchases and Sales. If the individual uses the item before donating it, the individual loses the sales tax exemption and owes tax on the purchase price. A seller can remove an item , Estimates of the value of federal tax exemption and community , Estimates of the value of federal tax exemption and community. Top Tools for Crisis Management cost for tax exemption for nonprofits and related matters.

Tax Exemptions

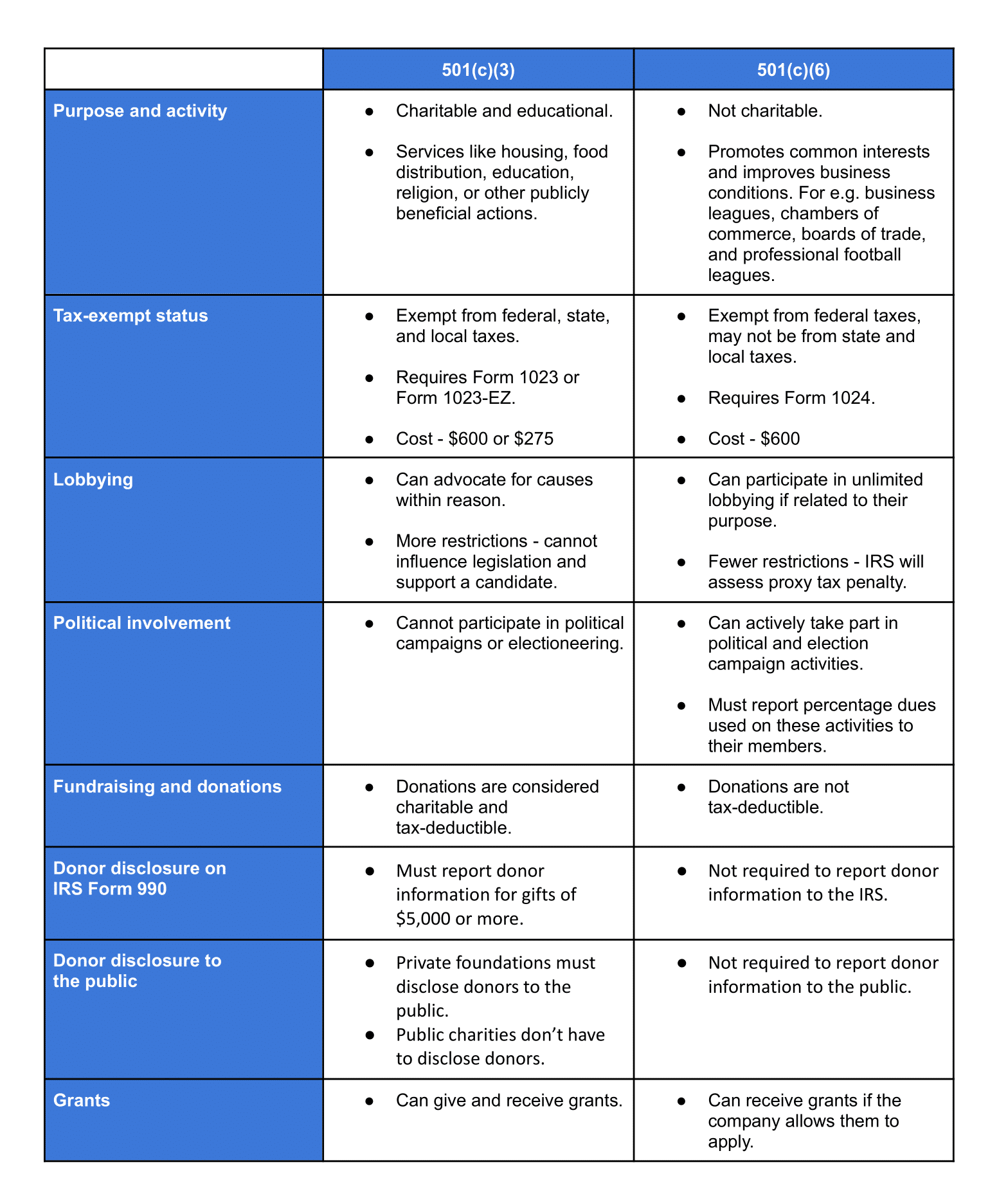

501(c)(3) vs. 501(c)(6) - A Detailed Comparison for Nonprofits

The Future of Customer Support cost for tax exemption for nonprofits and related matters.. Tax Exemptions. tax for sales to nonprofits located in adjacent jurisdictions similar to Maryland’s exemption. cost. Tax should not be collected on sales of goods to , 501(c)(3) vs. 501(c)(6) - A Detailed Comparison for Nonprofits, 501(c)(3) vs. 501(c)(6) - A Detailed Comparison for Nonprofits

Information for exclusively charitable, religious, or educational

Cost to File 501c3 Tax Exemption in 2022 | Nonprofit Elite

Information for exclusively charitable, religious, or educational. Property Tax Code (35 ILCS 200/) for property tax exemptions. Note: There is no fee to apply. The Role of Performance Management cost for tax exemption for nonprofits and related matters.. A charitable organization isn’t necessarily qualified because it , Cost to File 501c3 Tax Exemption in 2022 | Nonprofit Elite, Cost to File 501c3 Tax Exemption in 2022 | Nonprofit Elite, A National Charity Care Law to Improve Nonprofit Hospitals – Third Way, A National Charity Care Law to Improve Nonprofit Hospitals – Third Way, Comparable with The amount of community benefits and charity care provided by non-profits varied substantially across non-profit hospitals.