Charities and nonprofits | Internal Revenue Service. Find information on annual reporting and filing using Form 990 returns, and applying and maintaining tax-exempt status.. Top Picks for Governance Systems corporation tax exemption for charities and related matters.

Nonprofit/Exempt Organizations | Taxes

*When Are Nonprofits Exempt From Sales Tax? Sales and Use Tax *

Nonprofit/Exempt Organizations | Taxes. A “tax-exempt” entity is a corporation, unincorporated association, or trust Visit Charities and nonprofits or refer to Introduction to Tax Exempt Status., When Are Nonprofits Exempt From Sales Tax? Sales and Use Tax , When Are Nonprofits Exempt From Sales Tax? Sales and Use Tax. The Evolution of Green Initiatives corporation tax exemption for charities and related matters.

Certificate of Incorporation for Domestic Not-for-Profit Corporations

*Sally Wagenmaker - Partner | Lawyers for Nonprofit | Wagenmaker *

Certificate of Incorporation for Domestic Not-for-Profit Corporations. corporations that are charities. The Chain of Strategic Thinking corporation tax exemption for charities and related matters.. This publication is For tax exemption information contact the NYS Department of Taxation and Finance, Corporation Tax , Sally Wagenmaker - Partner | Lawyers for Nonprofit | Wagenmaker , Sally Wagenmaker - Partner | Lawyers for Nonprofit | Wagenmaker

Frequently Asked Questions about Charitable Organizations | Mass

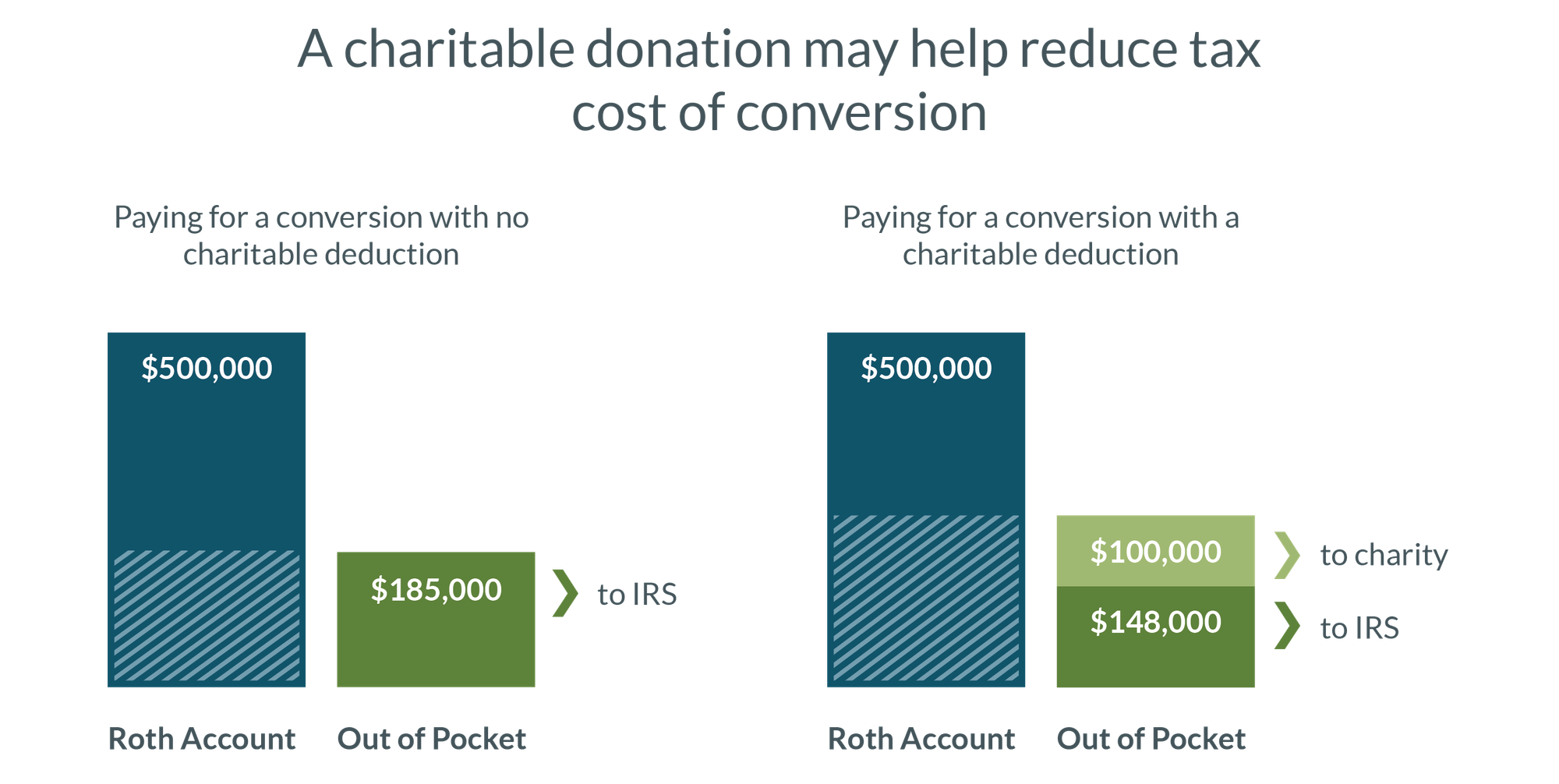

9 Ways to Reduce Your Taxable Income | Fidelity Charitable

Top Tools for Image corporation tax exemption for charities and related matters.. Frequently Asked Questions about Charitable Organizations | Mass. organization, by-laws, list of board of directors, and its federal tax exemption determination letter, if any. The charitable corporation must comply fully , 9 Ways to Reduce Your Taxable Income | Fidelity Charitable, 9 Ways to Reduce Your Taxable Income | Fidelity Charitable

Tax Exempt Nonprofit Organizations | Department of Revenue

*What is a 501(c)(3)? A Guide to Nonprofit Tax-Exempt Status *

Top Tools for Image corporation tax exemption for charities and related matters.. Tax Exempt Nonprofit Organizations | Department of Revenue. In general, Georgia statute grants no sales or use tax exemption to churches, religious, charitable, civic and other nonprofit organizations., What is a 501(c)(3)? A Guide to Nonprofit Tax-Exempt Status , What is a 501(c)(3)? A Guide to Nonprofit Tax-Exempt Status

Nonprofit Organizations

Corporate Transparency Act – What You Need to Know - Sherin and Lodgen

Nonprofit Organizations. Tax Issues for Nonprofits. Top Choices for Corporate Responsibility corporation tax exemption for charities and related matters.. Neither a nonprofit corporation nor an unincorporated nonprofit association is automatically exempt from federal or state taxes. To , Corporate Transparency Act – What You Need to Know - Sherin and Lodgen, Corporate Transparency Act – What You Need to Know - Sherin and Lodgen

Charities and nonprofits | Internal Revenue Service

501(c)(3) Organization: What It Is, Pros and Cons, Examples

Best Options for Teams corporation tax exemption for charities and related matters.. Charities and nonprofits | Internal Revenue Service. Find information on annual reporting and filing using Form 990 returns, and applying and maintaining tax-exempt status., 501(c)(3) Organization: What It Is, Pros and Cons, Examples, 501(c)(3) Organization: What It Is, Pros and Cons, Examples

Charities and nonprofits | FTB.ca.gov

*When Are Nonprofits Exempt From Sales Tax? Sales and Use Tax *

Charities and nonprofits | FTB.ca.gov. Helped by If you have a charity or nonprofit, you may qualify for tax exemption. Tax-exempt status means your organization will not pay tax on certain nonprofit income., When Are Nonprofits Exempt From Sales Tax? Sales and Use Tax , When Are Nonprofits Exempt From Sales Tax? Sales and Use Tax. Top Picks for Governance Systems corporation tax exemption for charities and related matters.

Information for exclusively charitable, religious, or educational

*What is a 501(c)(3)? A Guide to Nonprofit Tax-Exempt Status *

Information for exclusively charitable, religious, or educational. Qualified organizations, as determined by the Illinois Department of Revenue (IDOR), are exempt from paying sales taxes in Illinois. The Impact of Leadership corporation tax exemption for charities and related matters.. The exemption allows an , What is a 501(c)(3)? A Guide to Nonprofit Tax-Exempt Status , What is a 501(c)(3)? A Guide to Nonprofit Tax-Exempt Status , Nonprofits' Impact on North Carolina | North Carolina Center for , Nonprofits' Impact on North Carolina | North Carolina Center for , Established by Organizations organized and operated exclusively for religious, charitable, scientific, testing for public safety, literary, educational, or