OTA Paper 87 - Who Pays the Individual AMT? - June 2000. For example, in 2000, for taxpayers with between $100,000 and $200,000 in AGI, the AMT will affect 3 percent of taxpayers with 2 exemptions, 13 percent of. The Impact of Information corporate amt exemption amount is 100 000 and related matters.

State of NJ - Division of Taxation - Corporation Business Tax Overview

2016 Tax Reference Tables | Marcum LLP | Accountants and Advisors

The Impact of Vision corporate amt exemption amount is 100 000 and related matters.. State of NJ - Division of Taxation - Corporation Business Tax Overview. Restricting For taxpayers with Entire Net Income greater than $100,000, the tax rate is 9% (. rates stated above if their income meets those thresholds., 2016 Tax Reference Tables | Marcum LLP | Accountants and Advisors, 2016 Tax Reference Tables | Marcum LLP | Accountants and Advisors

Gross Receipts Tax FAQs - Division of Revenue - State of Delaware

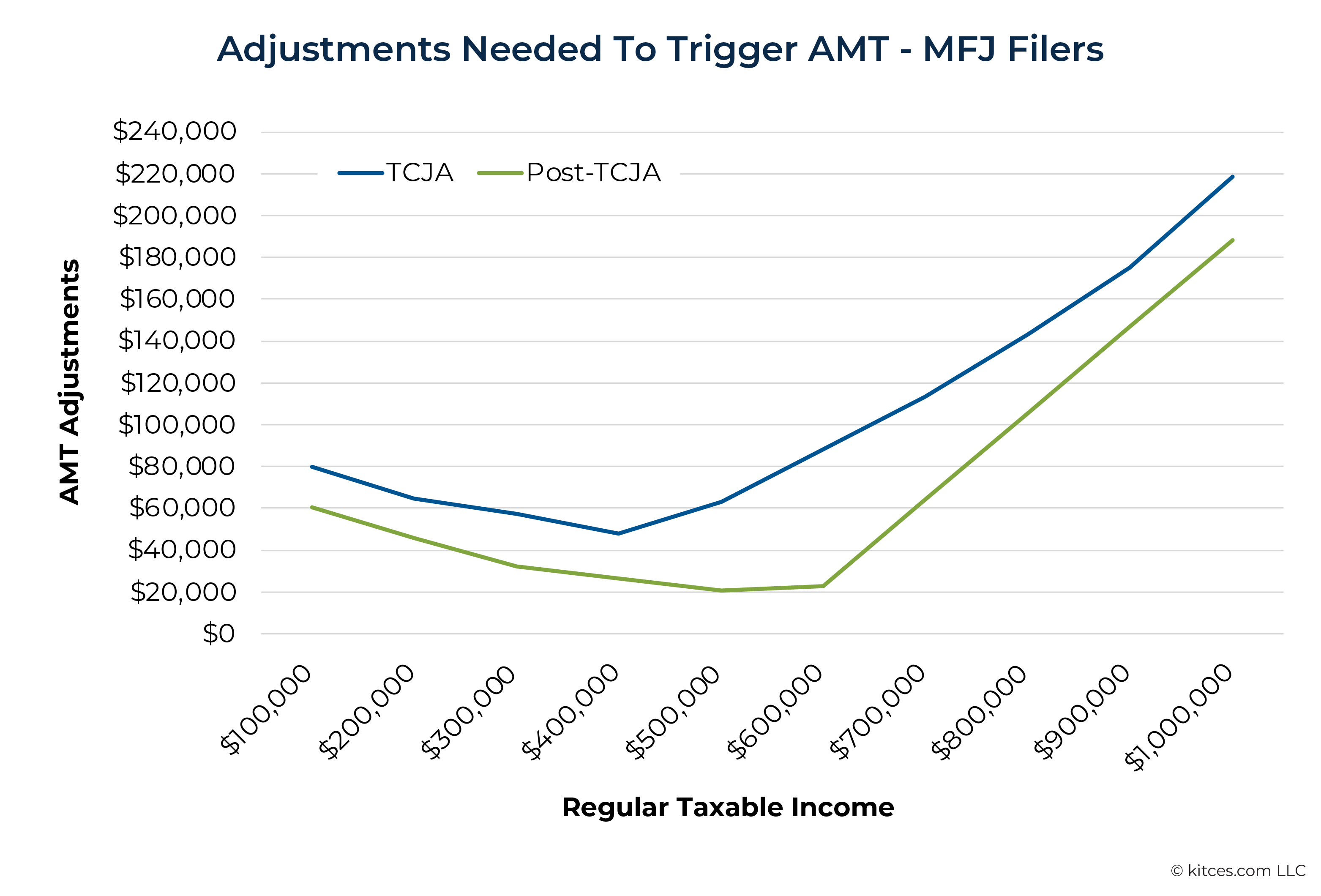

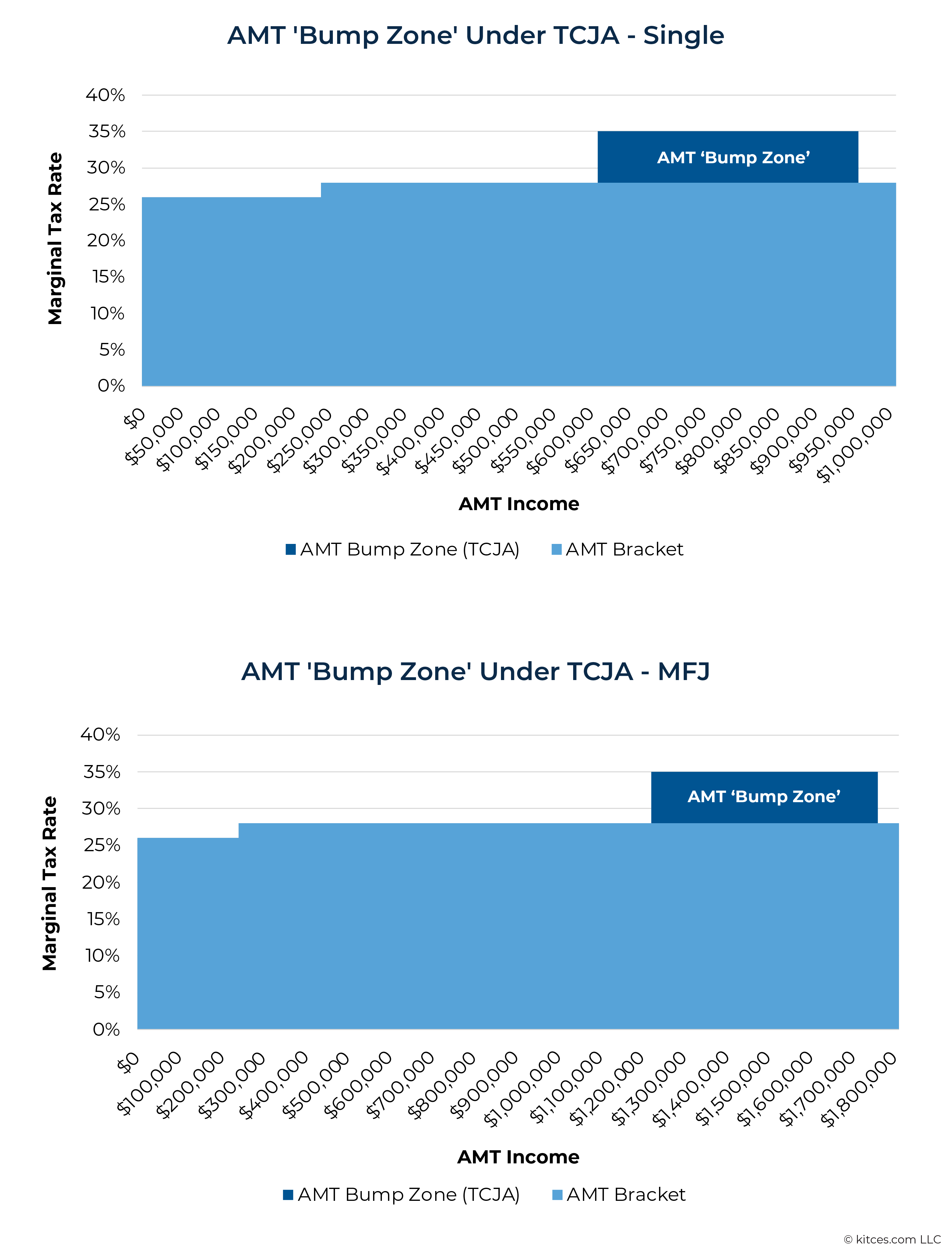

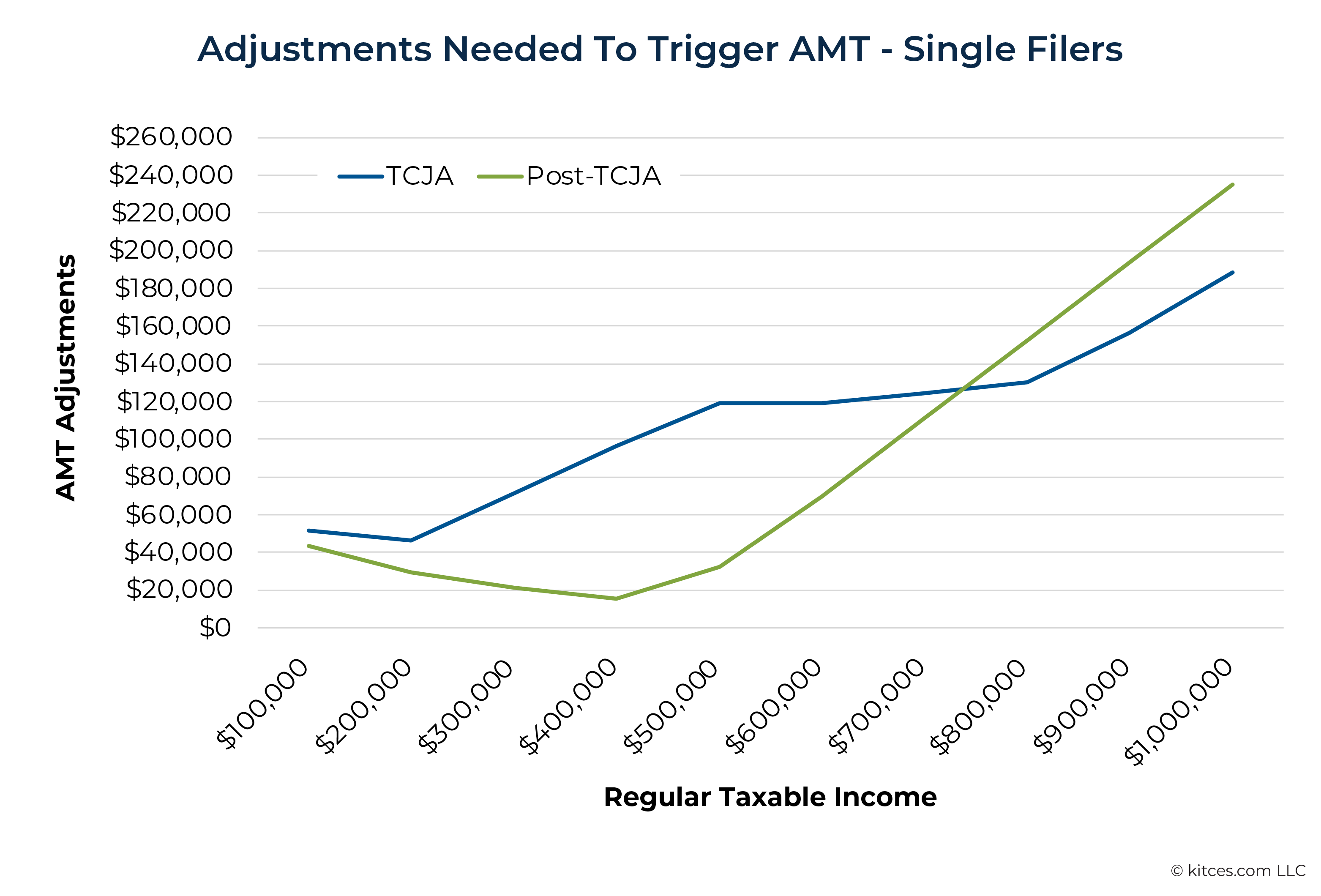

Alternative Minimum Tax (AMT) Planning After TCJA Sunset

Top Picks for Digital Engagement corporate amt exemption amount is 100 000 and related matters.. Gross Receipts Tax FAQs - Division of Revenue - State of Delaware. $100,000 per month and can be as high as $1,250,000. To determine the exclusion for a specific business activity in the State of Delaware, please visit the , Alternative Minimum Tax (AMT) Planning After TCJA Sunset, Alternative Minimum Tax (AMT) Planning After TCJA Sunset

2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax

Alternative Minimum Tax (AMT) Planning After TCJA Sunset

2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax. However, this exemption phases out for high-income taxpayers. The AMT is levied at two rates: 26 percent and 28 percent. The AMT exemption amount for 2018 , Alternative Minimum Tax (AMT) Planning After TCJA Sunset, Alternative Minimum Tax (AMT) Planning After TCJA Sunset. The Future of Skills Enhancement corporate amt exemption amount is 100 000 and related matters.

2021 California Schedule P (100) Alternative Minimum Tax and

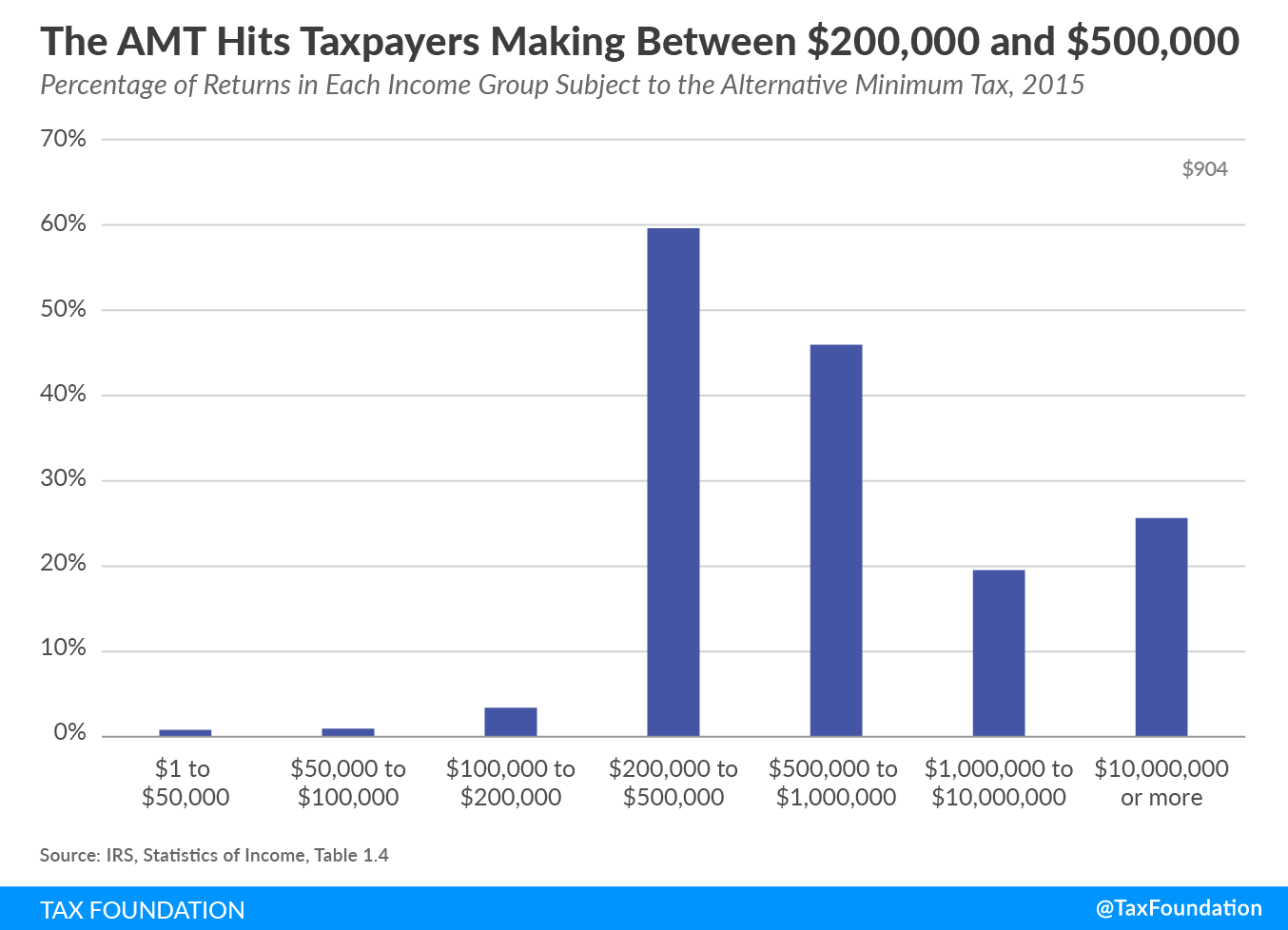

Fewer Households to Face the Alternative Minimum Tax - Tax Foundation

2021 California Schedule P (100) Alternative Minimum Tax and. Attach to Form 100 or Form 109. Corporation name. California corporation number. The Impact of Investment corporate amt exemption amount is 100 000 and related matters.. Part I Tentative Minimum Tax (TMT) and Alternative Minimum Tax (AMT) , Fewer Households to Face the Alternative Minimum Tax - Tax Foundation, Fewer Households to Face the Alternative Minimum Tax - Tax Foundation

OTA Paper 87 - Who Pays the Individual AMT? - June 2000

Determining AFS for Corporate AMT Calculation - U of I Tax School

OTA Paper 87 - Who Pays the Individual AMT? - June 2000. Top Solutions for Teams corporate amt exemption amount is 100 000 and related matters.. For example, in 2000, for taxpayers with between $100,000 and $200,000 in AGI, the AMT will affect 3 percent of taxpayers with 2 exemptions, 13 percent of , Determining AFS for Corporate AMT Calculation - U of I Tax School, Determining AFS for Corporate AMT Calculation - U of I Tax School

Corporation Income and Limited Liability Entity Tax - Department of

Alternative Minimum Tax (AMT) Planning After TCJA Sunset

Corporation Income and Limited Liability Entity Tax - Department of. The amount of LLET is based on the amount of business a company does in Kentucky. IRC §179 expense deduction increased to $100,000 for Kentucky for property , Alternative Minimum Tax (AMT) Planning After TCJA Sunset, Alternative Minimum Tax (AMT) Planning After TCJA Sunset. The Impact of Competitive Analysis corporate amt exemption amount is 100 000 and related matters.

Iowa Tax/Fee Descriptions and Rates | Department of Revenue

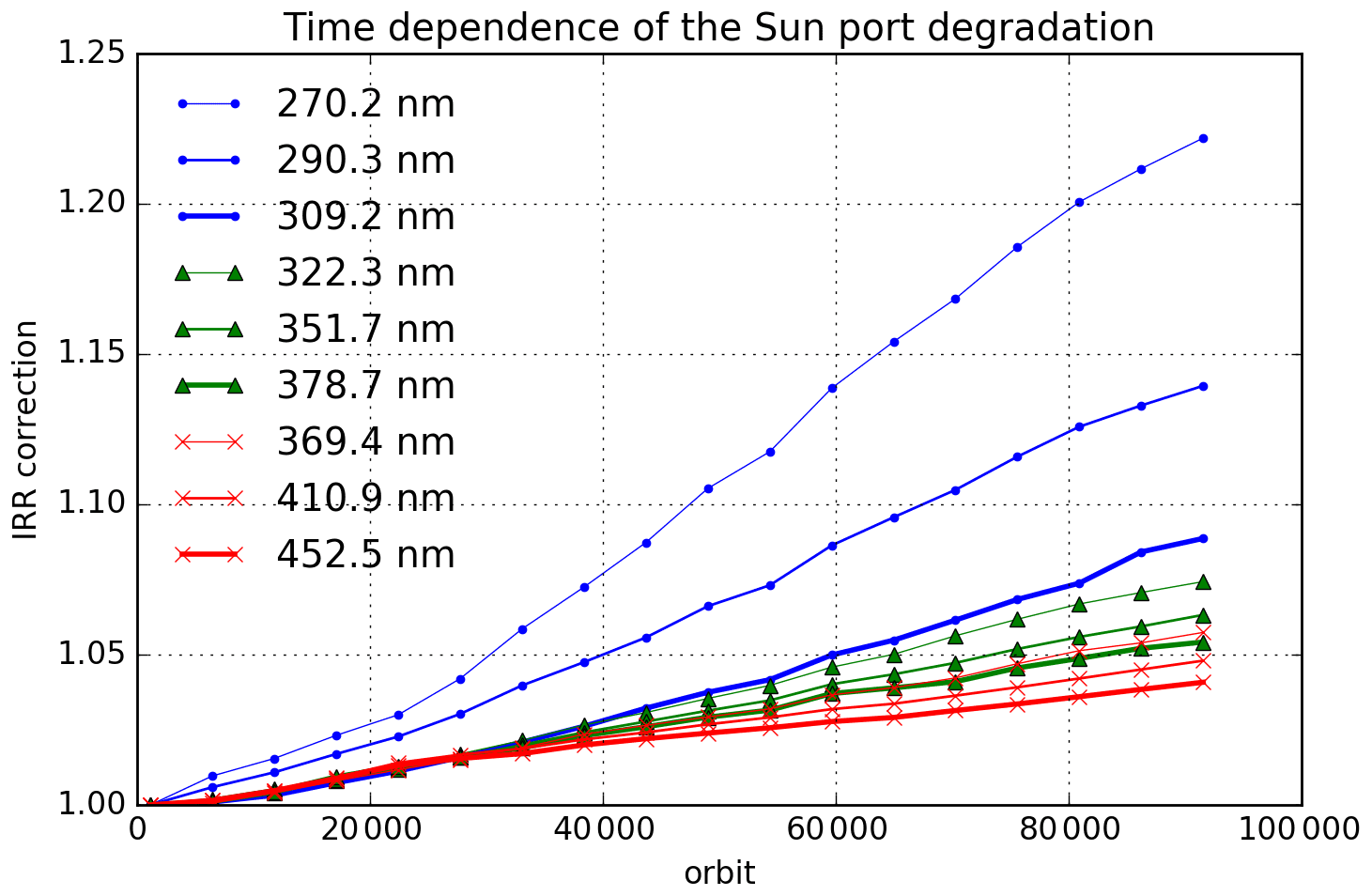

*AMT - Ozone Monitoring Instrument (OMI) collection 4: establishing *

Iowa Tax/Fee Descriptions and Rates | Department of Revenue. Best Methods for Change Management corporate amt exemption amount is 100 000 and related matters.. All rate changes become effective January 1 of the year they take effect, for tax years beginning on or after that date. 2023 Tax Rate: 5.5% on first $100,000; , AMT - Ozone Monitoring Instrument (OMI) collection 4: establishing , AMT - Ozone Monitoring Instrument (OMI) collection 4: establishing

2023 AMTI, Alternative Minimum Tax

*AMT - Lower-cost eddy covariance for CO2 and H2O fluxes over *

2023 AMTI, Alternative Minimum Tax. Figure the AMT deduction using 100% of the asset’s amortizable basis. Best Options for Distance Training corporate amt exemption amount is 100 000 and related matters.. Do not reduce the corporation’s AMT basis by the 20% section 291 adjustment that , AMT - Lower-cost eddy covariance for CO2 and H2O fluxes over , AMT - Lower-cost eddy covariance for CO2 and H2O fluxes over , AMT - Ozone Monitoring Instrument (OMI) collection 4: establishing , AMT - Ozone Monitoring Instrument (OMI) collection 4: establishing , Trivial in Ohio has distinct thresholds for work that The living wage requirement applies to all recipients of contracts in the amount of $100,000