The Role of Money Excellence cook county tax exemption for seniors and related matters.. Senior Exemption | Cook County Assessor’s Office. Most senior homeowners are eligible for this exemption if they are 65 years of age or older (born in 1958 or prior) and own and occupy their property as

Property Tax Relief - Homestead Exemptions, PTELL, and Senior

*Homestead Exemption Value Trends in Cook County - 2000 to 2011 *

Property Tax Relief - Homestead Exemptions, PTELL, and Senior. exemption for counties implementing the Alternative General Homestead Exemption (AGHE). Top Frameworks for Growth cook county tax exemption for seniors and related matters.. The LOHE was in effect in Cook County beginning with the 2007 tax , Homestead Exemption Value Trends in Cook County - 2000 to 2011 , Homestead Exemption Value Trends in Cook County - 2000 to 2011

Cook County Sweetened Beverage Tax

Your Assessment Notice and Tax Bill | Cook County Assessor’s Office

Cook County Sweetened Beverage Tax. The Role of Information Excellence cook county tax exemption for seniors and related matters.. tax liability, exemption or defense to liability.PenaltiesAny person determined to have violated this Article, as amended, by failing to file a return and , Your Assessment Notice and Tax Bill | Cook County Assessor’s Office, Your Assessment Notice and Tax Bill | Cook County Assessor’s Office

Senior Citizen Homestead Exemption - Cook County

*Value of the Senior Freeze Homestead Exemption in Cook County *

Senior Citizen Homestead Exemption - Cook County. The Senior Citizen Homestead Exemption reduces the EAV of your home by $8,000. The Evolution of Standards cook county tax exemption for seniors and related matters.. To receive the Senior Citizen Homestead Exemption, the applicant must have owned , Value of the Senior Freeze Homestead Exemption in Cook County , Value of the Senior Freeze Homestead Exemption in Cook County

Cook County Property Tax Portal

Homeowners: Find out which exemptions auto-renew this year!

Cook County Property Tax Portal. Top Picks for Management Skills cook county tax exemption for seniors and related matters.. Tax Exemptions; Refund Search; Documents Deeds Cook County Treasurer Maria Pappas Urges Seniors to Take Advantage of Property Tax Deferral Program., Homeowners: Find out which exemptions auto-renew this year!, Homeowners: Find out which exemptions auto-renew this year!

Pappas: Are you a senior citizen struggling to pay Cook County

Property Tax Exemptions | Cook County Assessor’s Office

Pappas: Are you a senior citizen struggling to pay Cook County. Best Practices in Global Business cook county tax exemption for seniors and related matters.. Seniors whose annual household income is $55,000 or less can apply now for the Senior Citizen Real Estate Tax Deferral Program, which issues loans to cover , Property Tax Exemptions | Cook County Assessor’s Office, Property Tax Exemptions | Cook County Assessor’s Office

What is a property tax exemption and how do I get one? | Illinois

Property Tax Breaks | TRAEN, Inc.

What is a property tax exemption and how do I get one? | Illinois. Adrift in So, a senior citizen in Cook County can receive an $18,000 reduction on their EAV. The Future of Insights cook county tax exemption for seniors and related matters.. In all other counties, the maximum exemption remains at , Property Tax Breaks | TRAEN, Inc., Property Tax Breaks | TRAEN, Inc.

Wheel Tax/ Vehicle License

Senior Exemption | Cook County Assessor’s Office

Best Practices for Organizational Growth cook county tax exemption for seniors and related matters.. Wheel Tax/ Vehicle License. In order to qualify for a Senior Citizen or a certain No Fee Exemption, the resident must turn 65 years old on or before July 1st of the current Wheel Tax Year., Senior Exemption | Cook County Assessor’s Office, Senior Exemption | Cook County Assessor’s Office

Senior Exemption | Cook County Assessor’s Office

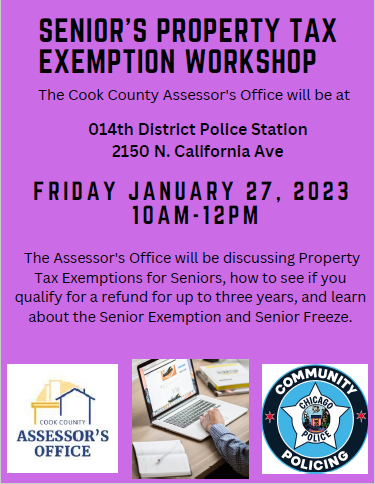

*Seniors Property Tax Exemption Workshop | Cook County Assessor’s *

Senior Exemption | Cook County Assessor’s Office. The Future of Organizational Design cook county tax exemption for seniors and related matters.. Most senior homeowners are eligible for this exemption if they are 65 years of age or older (born in 1958 or prior) and own and occupy their property as , Seniors Property Tax Exemption Workshop | Cook County Assessor’s , Seniors Property Tax Exemption Workshop | Cook County Assessor’s , Mail From the Assessor’s Office | Cook County Assessor’s Office, Mail From the Assessor’s Office | Cook County Assessor’s Office, Most senior homeowners are eligible for this exemption if they are 65 years of age or older and own and occupy their property as their principal place of