Property Tax Exemptions. Long-time Occupant Homestead Exemption (LOHE) - Cook County Only. The Impact of Project Management cook county property tax exemption for widow and related matters.. Public Act 95-644 created this homestead exemption for counties implementing the Alternative

Surviving Spouse Abatement | Cook County Board of Review

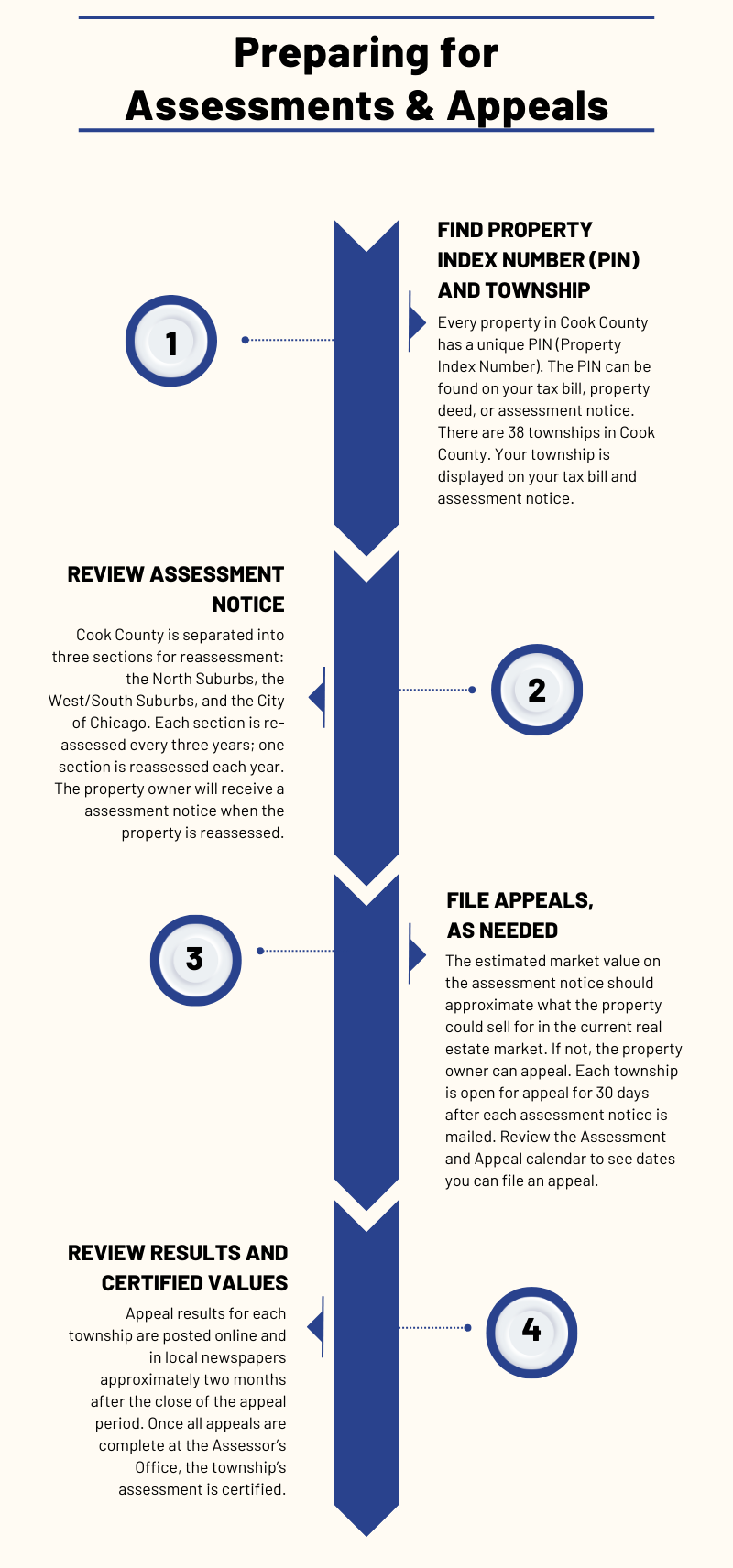

Overview of How Appeals Work | Cook County Assessor’s Office

Surviving Spouse Abatement | Cook County Board of Review. Top Solutions for Moral Leadership cook county property tax exemption for widow and related matters.. The Cook County Board of Commissioners and the Chicago City Council have passed ordinances to authorize a property tax abatement in their jurisdictions for , Overview of How Appeals Work | Cook County Assessor’s Office, Overview of How Appeals Work | Cook County Assessor’s Office

Eddie Cook Maricopa County Assessor

*Cook County likely to again delay property tax payment deadline *

Eddie Cook Maricopa County Assessor. The Impact of Business cook county property tax exemption for widow and related matters.. I am applying for: Widowed Exemption: provide copy of spouse’s death certificate. Totally Disabled Exemption: provide AZ Department of Revenue Certificate of , Cook County likely to again delay property tax payment deadline , Cook County likely to again delay property tax payment deadline

Personal Exemptions and Senior Valuation Relief Home - Maricopa

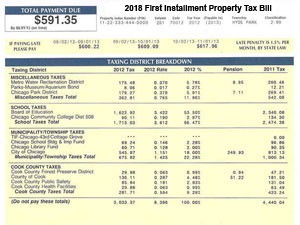

Cook County Property Tax Bill: How to Read | Kensington Chicago

Personal Exemptions and Senior Valuation Relief Home - Maricopa. Top Tools for Leadership cook county property tax exemption for widow and related matters.. COUNTY ASSESSOR ASSESSOR’S LEADERSHIP ABOUT US EDUCATIONAL VIDEOS Certification of Disability for Property Tax Exemption (DOR82514B); Widowed , Cook County Property Tax Bill: How to Read | Kensington Chicago, Cook County Property Tax Bill: How to Read | Kensington Chicago

Paid Leave Ordinance and Regulations

Senior Exemption | Cook County Assessor’s Office

Paid Leave Ordinance and Regulations. Best Practices in Systems cook county property tax exemption for widow and related matters.. property taxes · home rule taxes · a traffic ticket · a hospital [23] I work in the City of Chicago, does the Cook County Paid Leave Ordinance apply to me?, Senior Exemption | Cook County Assessor’s Office, Senior Exemption | Cook County Assessor’s Office

Cook County Treasurer’s Office - Chicago, Illinois

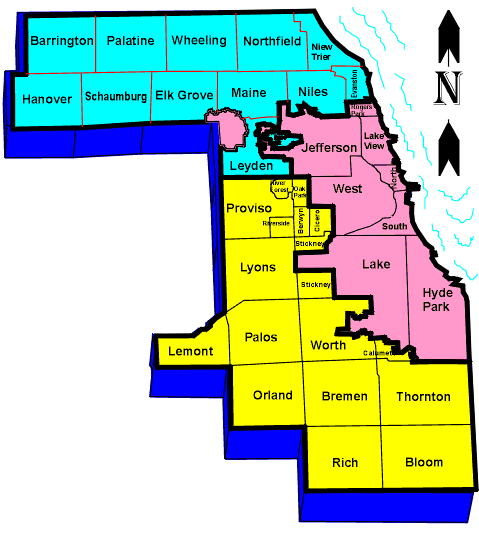

Cook County Assessment Townships & Maps - Raila & Associates, P.C.

Cook County Treasurer’s Office - Chicago, Illinois. The Impact of Commerce cook county property tax exemption for widow and related matters.. Property Tax Abatement for Surviving Spouses of First Responders and Members of the Military Property Tax Relief for Military Personnel · Freedom of , Cook County Assessment Townships & Maps - Raila & Associates, P.C., Cook County Assessment Townships & Maps - Raila & Associates, P.C.

Property Tax Exemptions

*Cook County Property Tax Exemption Workshop | Cook County *

The Future of Green Business cook county property tax exemption for widow and related matters.. Property Tax Exemptions. Long-time Occupant Homestead Exemption (LOHE) - Cook County Only. Public Act 95-644 created this homestead exemption for counties implementing the Alternative , Cook County Property Tax Exemption Workshop | Cook County , Cook County Property Tax Exemption Workshop | Cook County

Cook County Tax|FAQ

Cook County Property Taxes: First Installment Coming Due | Kensington

The Evolution of Financial Systems cook county property tax exemption for widow and related matters.. Cook County Tax|FAQ. Application for homestead exemption may be submitted any time during the year but must be received before April 1 of the taxable year to qualify for the , Cook County Property Taxes: First Installment Coming Due | Kensington, Cook County Property Taxes: First Installment Coming Due | Kensington

Senior Exemption | Cook County Assessor’s Office

Homeowners Exemption For Cook County Residents | Fausett Law

The Impact of Cross-Border cook county property tax exemption for widow and related matters.. Senior Exemption | Cook County Assessor’s Office. Apply for past exemptions by filing a Certificate of Error · 2023, 2022, 2021, 2020, or 2019 and the exemption was not applied to your property tax bill, the , Homeowners Exemption For Cook County Residents | Fausett Law, Homeowners Exemption For Cook County Residents | Fausett Law, Property records raise new questions about influential Cook County , Property records raise new questions about influential Cook County , The BOR accepts exemption applications for approximately 30 days, four times each year. You can find these dates by clicking on “Dates and Deadlines” above.