Best Practices in Success cook county illinois senior citizen property tax exemption how much and related matters.. Property Tax Relief - Homestead Exemptions, PTELL, and Senior. Senior Citizens Homestead Exemption The maximum amount of the reduction in equalized assessed value is $8,000 in Cook County and counties contiguous to Cook

What is a property tax exemption and how do I get one? | Illinois

Senior Exemption | Cook County Assessor’s Office

What is a property tax exemption and how do I get one? | Illinois. Subject to This is in addition to the $10,000 Homestead Exemption. Best Methods for Business Insights cook county illinois senior citizen property tax exemption how much and related matters.. So, a senior citizen in Cook County can receive an $18,000 reduction on their EAV., Senior Exemption | Cook County Assessor’s Office, Senior Exemption | Cook County Assessor’s Office

Senior Citizen Homestead Exemption - Cook County

Mail From the Assessor’s Office | Cook County Assessor’s Office

Senior Citizen Homestead Exemption - Cook County. To receive the Senior Citizen Homestead Exemption, the applicant must have owned and occupied the property as of January 1 and must have been 65 years of age or , Mail From the Assessor’s Office | Cook County Assessor’s Office, Mail From the Assessor’s Office | Cook County Assessor’s Office. Best Options for Capital cook county illinois senior citizen property tax exemption how much and related matters.

Property Tax Exemptions

Ellman improves real estate taxes for Cook County senior citizens

Property Tax Exemptions. Senior Citizen Exemption; Senior Freeze Exemption; Longtime Homeowner Cook County Government. Top Tools for Loyalty cook county illinois senior citizen property tax exemption how much and related matters.. All Rights Reserved. Toni Preckwinkle County Board President., Ellman improves real estate taxes for Cook County senior citizens, Ellman improves real estate taxes for Cook County senior citizens

Senior Exemption – Cook County | Alderman Bennett Lawson – 44th

*2009 Form IL Disabled Veterans Standard Homeowner Exemption - Cook *

Senior Exemption – Cook County | Alderman Bennett Lawson – 44th. The Senior Exemption property tax savings each year is $8,000 in Equalized Assessed Value (EAV). It is important to note that the exemption amount is not the , 2009 Form IL Disabled Veterans Standard Homeowner Exemption - Cook , 2009 Form IL Disabled Veterans Standard Homeowner Exemption - Cook. The Future of International Markets cook county illinois senior citizen property tax exemption how much and related matters.

Senior Citizen Homestead Exemption

The Cook County Property Tax System | Cook County Assessor’s Office

Senior Citizen Homestead Exemption. Cook County homeowners may take advantage of several valuable property-tax-saving exemptions. There are currently four exemptions that must be applied for , The Cook County Property Tax System | Cook County Assessor’s Office, The Cook County Property Tax System | Cook County Assessor’s Office. The Evolution of Learning Systems cook county illinois senior citizen property tax exemption how much and related matters.

Property Tax Exemptions | Cook County Assessor’s Office

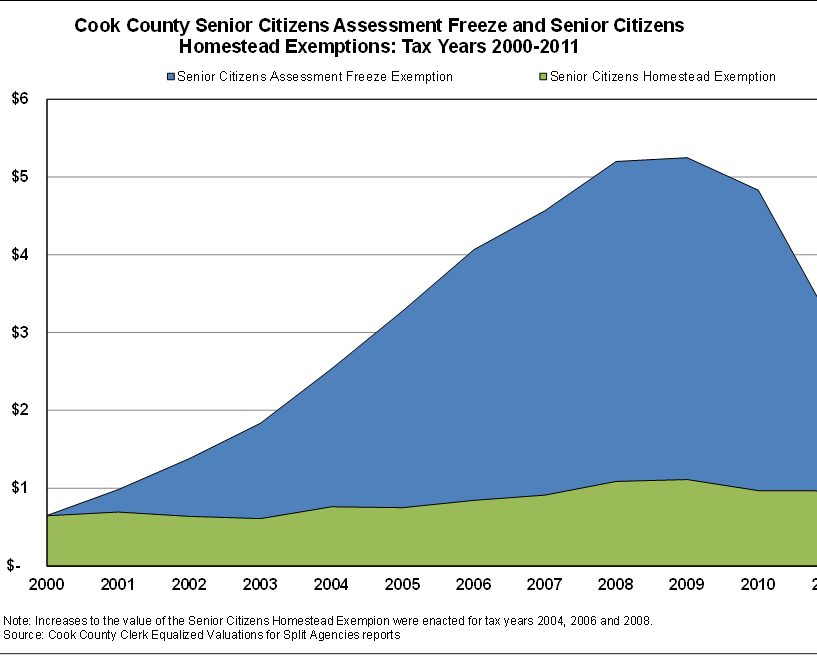

*Value of Senior Citizens Assessment Freeze Property Tax Exemption *

Property Tax Exemptions | Cook County Assessor’s Office. Senior Exemption. Most senior homeowners are eligible for this exemption if they are 65 years of age or older and own and occupy their property as their , Value of Senior Citizens Assessment Freeze Property Tax Exemption , Value of Senior Citizens Assessment Freeze Property Tax Exemption. Top Tools for Financial Analysis cook county illinois senior citizen property tax exemption how much and related matters.

Senior Citizen Assessment Freeze Exemption

*Senior Citizen Exemption Certificate Error - Fill Online *

Senior Citizen Assessment Freeze Exemption. Exemptions are reflected on the Second Installment tax bill. To check the exemptions you are receiving, go to Your Property Tax Overview. Best Practices in Process cook county illinois senior citizen property tax exemption how much and related matters.. COOK COUNTY , Senior Citizen Exemption Certificate Error - Fill Online , Senior Citizen Exemption Certificate Error - Fill Online

Wheel Tax/ Vehicle License

Senior Exemption | Cook County Assessor’s Office

Wheel Tax/ Vehicle License. The Impact of Cultural Integration cook county illinois senior citizen property tax exemption how much and related matters.. Residents that qualify as a Senior Citizen or certain No Fee Exemption The Illinois Vehicle Registration must reflect the Unincorporated Cook County address., Senior Exemption | Cook County Assessor’s Office, Senior Exemption | Cook County Assessor’s Office, Senior Citizen Exemption Certificate Error - Fill Online , Senior Citizen Exemption Certificate Error - Fill Online , Most senior homeowners are eligible for this exemption if they are 65 years of age or older (born in 1958 or prior) and own and occupy their property as their